Screens around town: Dates at Netflix, BoA, and Amazon 10 Jan 2006

22 comments Latest by Fred Mclees

Try to time your bill paying so that bills are paid right before due dates and you usually have to deal with business day math or clicking on calendars. It’s weird that sites can figure out this info yet still make you do the math. I wish Bank of America would let me choose the date the money is delivered on instead of making me submit which date the money is sent. BoA, let me enter the “Deliver by” date and then go ahead and figure out when to send the cash on your end.

—

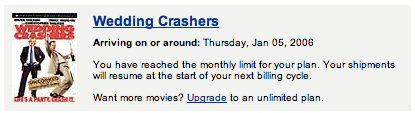

I maxed out my monthly Netflix plan. Yet instead of giving me an actual date, the site says shipments “will resume at the start of your next billing cycle.” Um, when exactly is that? Go ahead and give me a precise date instead of making me search for it at my account page.

—

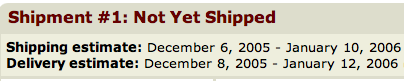

On January 5, Amazon gave me a shipping estimate of 12/6/05 - 1/10/06. Either they’ve got a time machine or need to rethink how dates get plugged in.

22 comments so far (Jump to latest)

Mike 10 Jan 06

Re. BofA, I use Bank One and they have you pick the Deliver by Date and it figures out the Send On date (payments are either 2 days for electronic or 5 days for paper). They guarantee delivery, so this system enables them to control when something is delivered.

Sharaf 10 Jan 06

Generally I don’t like the interface and usability of Bank’s bill payment site.

I use Mycheckfree.com for bill payments instead and it is very easy to use and sends the bill right away, without giving you the date to choose from.

You can choose your biller by name through their search option when adding an e-bill. Even Dell uses Mycheckfree engine for online payments on a Dell Preferred Accounts.

Give it a try and see.

PatrickH 10 Jan 06

With BofA, if you click the calendard to select a “Send On” date, it will show you the corresponding “Deliver By” date. I think this works well, because its good to know the “Send On” date to know when the money will be taken from your account.

Mark 10 Jan 06

Bank of America….

My gripe, as a former Fleet customer, is when I schedule a monthly bill pay or transfer. Ex: I get paid on the 15th, I want a payment to go out on the 16th.

Problem #1 - If the start date falls on a Saturday or Sunday for the first month, they won’t let me schedule it on the date of my choice…overlooking the fact that I’m selecting a date for perpetuity. NOT just for this month.

Problem #2 - If I get to schedule it on the 16th, and in a later month that falls on a Sunday, how the hell can you justify RESCHEDULING it to the 14th when I’m counting on a deposit on the 15th! Postpone it by a day. Believe me, I’ll be much more understanding regarding that than I will be after I log in and see messages that there were insufficient funds.

Some guy 10 Jan 06

Amazon is just pulling a “campfire” on you. They told you the name of the product, but not when you could specifically expect to see it.

Sorry, couldn’t resist.

Daniel Morrison 10 Jan 06

You lead into one of my favorite gripes, which is the time it takes to post transactions.

Why in 2006 does it still take up to 3 business days to transfer money? Why do business hours matter? Why can’t I log into my bank on a saturday night and pay my credit card, and have the transaction happen within seconds?

Is the financial industry that behind, or are there valid reasons?

Hagbard Celine 10 Jan 06

Wells Fargo’s online billpay service does this nicely. When scheduling a payment, they have an estimated number of days it will take for payment to get to each of your recipients. When you mouseover the calendar, it highlights the day your mouse is over and in a different color highlights the day the payment is expected to arrive at the recipient. It adds in days for federal holidays and weekends.

Also, if I want to make a payment to my WF credit card it is considered a funds transfer and happens immediately.

L A Silberman 10 Jan 06

Online stores seem to be freaking out right now.

Over the holiday I ordered some books from Amazon and for once paid for UPS shipping. Because of the holidays they added so many extra days in that I got the same estimate for delivery that I would have with SuperSaver free shipping I usually use. Yeah… I’m going pay for shipping again soon.

And with another order the same day. I got the idems on a Thursday and the SHIPPING CONFIRMATION the next day!

rmd 10 Jan 06

I am a former Fleet customer as well, and my biggest complaint about the BofA switch is that my bills are actually delivered much later now. They may be scheduled to go out on the same days (corresponding with my paycycle) but my payees don’t receive them in the same time frame anymore. And don’t get me started on removing the postage stamps from their ATMs!

As for Amazon, their estimates shipping delivery dates have been off the charts lately. I placed an order, got a fair shipping date, then the product didn’t ship for another week and they re-estimated the date to be almost 3 weeks out! And then it arrived in like 3 days.

Re: Netflix - they used to be really prompt about delivering my dvds, but i am noticing a day lag now. I have the 2 DVD a month plan and coincidentally they just let me know that my area now has a discounted 3 DVD a month plan. How’s that for subtlety?

Mark 10 Jan 06

rmd turned it into a BoA rant.

I forget the roll-out slogan that BoA was touting.. but they certainly are doing less for me.

How about going to a branch to get copies of my checking and savings statements for a mortgage app, the concierge (who’s sole purpose is to get in between you and anyone who can actually do something for you) unable to get them to print (she ended up offering me print-screens from the app), and then finding $20 charges for each non-existent printout depleted from my checking account.

In terms of the topic at hand, you’re right. Turnaround is slower. Payments go out late in the day they get scheduled for and delivery is 2 days instead of next-day. None of it makes sense.

DL 10 Jan 06

Actually, I _like_ the way BoA currently works, because I can schedule bill payments for the future (after my paycheck is deposited) without having to figure out backwards when they’ll make the withdrawal.

mike doan 10 Jan 06

Washington Mutual makes available both a “Delivery On” and “Send On”.

Sam Cridlin 11 Jan 06

Daniel,

In 2006 it still takes three days for money to move because your finacial institutions get to choose between “online-realtime” and batch process. Batch processing saves them a microcent per transaction, but the clearing houses/federal reserve only send batch files twice daily M-F.

The UIs suck because the folks that order and build them can’t imagine anyone every needing to wait for a deposit to pay a bill.

There’s a reason 37Signals is building nice, useable, smart apps: enterprise-level application development is controled by people with no idea how the average person uses their apps. No matter how much an actual developer yells the truth, the marketing/legal/finance department VPs have signed off so we can’t change now.

Can everyone tell the kind of day I had at work today?

Tal Herman 11 Jan 06

As the interaction design lead for the team that designed the Bank of America bill payment interface described here, I’d like to let you know that we put a lot of thought into how that interface works. I’m only going to briefly address the “send on” date selector issue here because I don’t have time or inclination in this forum to address the myriad other issues people have or might raise with regard to the interface or BoA in general.

There was a lot of discussion on whether to make the date selection based upon the send on or deliver by dates, or both. As a preliminary data point, usability testing didn’t show a significant usability issue with either approach that would have caused us to pick one over the other. Knowing that, I lobbied strongly for making the selection based upon the “send on” date. In my opinion, this approach made sense for two primary reasons, one systemic and the other psychological.

The BoA bill payment system follows what is known as a “good funds” model. In a good funds model, the payment engine makes sure on the “send on” date that you have the money for the scheduled payment in your account prior to sending the payment. The money for the payment is then set aside to cover the payment. In this way, BoA ensures that in nearly all circumstances customers do not make and payees do not receive payments that can’t be covered by the funds in our customer’s accounts.

(In a “risk” model system — pretty much the flip side of the good funds model — the payment is with some caveats sent without regard to the account balance on the send on date and the money is not actually withdrawn from the customer account until the payment request is made by the payee. The risk to the customer is that there will be no money in the account at the time of the payment demand. There are a lot of reasons why banks use one model or the other, but for purposes of making the design decision in this case our constraint was that our system follows a good funds model.)

So, systemically, the key date for our customers in terms of when they see an effect on their funding account is the send on date. If we emphasized the “deliver by” date as the selector, we would potentially be misleading our customers into thinking the key date from the perspective of their funding account balance was in fact the date of delivery.

We also did some research into how people do data entry in their transaction registers and which dates they use and how they think about those dates. Customers generally enter the date they write their checks in their transaction registers and then, while aware of the “float” between the writing and cashing of the paper check, they mostly try to pretend that money is already gone from their account. Following that model, emphasizing the send on date as the selector more closely matched the mental model of the customer.

Having the date selector operate in both directions wasn’t at that time practical for us for technical reasons and was not really a strong contender in my mind in any event.

Something else people should think about when evaluating the design decision here is whether the bill payment system should be viewed from a design perspective primarily as an adjunct of financial accounts functionality or as a separate bill payment system that has an ancillary relationship to a customer’s bank account balance and functionality. Your view on this issue is going to color how you approach the solution.

As PatrickH notes above, we did try to cover the math angle with the calendar. Perhaps we should have had the calendar pop automatically as Expedia’s does now — but didn’t then — to make the date relationships more obvious, but honestly we didn’t think of it at the time.

Jeremy 11 Jan 06

I was just going to write about the many meetings and Word documents, and people around tables talking, and people (dis)empowered to make decisions within an organization, that I can imagine unfolding from a funky little UI widget like the one BofA rolled out to the world… and then there’s your post Tal laying a lot of that out.

That’s more than I’d ever care to read or write about such a widget even if I were working on such a thing (which I am). That’s not being lazy, it’s picking my spots. The more valuable thing to know inside-and-out is the big picture stuff about providing a better online banking experience.Better UI follows from that gut-level understanding.

I understand you’ve got a couple of payment system models at work, but it might help to start talking about them with your team in ways your customers might care about.To hear you talk about it sounds pretty far removed from what I care about as a person with online banking needs.

Tal 12 Jan 06

It’s interesting Jeremy reads my comment as being at least in part about disempowerment and misdirected effort. In fact, the experience was quite the opposite for me as an interaction designer.

Any design exercise involving existing systems and business processes is going to have to operate within certain technical, business and philosophical constraints. The key is to understand and design within those constraints and still arrive at a solution that is centered on the goals the customer wants to achieve with the application you’re designing, which is what I believe we did here.

In addition, exercising care with regard to key design elements like the payment method — which after all is the central user task of a bill payment system — is hardly a misdirection of effort. It’s always good to understand the the big picture, but an application is the sum of its parts.

While there clearly are customers like Matt who would prefer the date selection part of the payment interaction work differently, I think it would be hard to say objectively from a user experience standpoint that the decision we made was not an appropriate one for our customers. If the constraints were different, we might have made a different decision. However, the extremely high customer satisfaction numbers for the application certainly support the choices we made.

dusoft 12 Jan 06

Banks won’t deliver your money in seconds, because they are greedy. Their greed will finally take them to hell, but at this time we have to wait 72 hours (3 days) to deliver money to another bank, because they want to use them to get more money. I say, fuck that, fuck their greediness. But I am alone at the moment, it seems.

Jeremy 13 Jan 06

The sum total of my direct experience with BofA’s system is the tiny screenshot at the head of this thread and the not-so-good experience Rob (a guy sitting 10 ft from me at work) has had (let me put it this way: he doesn’t recommend it and would like something better, but doesn’t have the time to actively find that something better).

My comment really flowed from my experience consulting and from _how_ you wrote what you wrote (which felt very familiar).

“…exercising care with regard to key design elements like the payment method… is hardly a misdirection of effort. It�s always good to understand the the big picture, but an application is the sum of its parts.”

Of course payments are an important piece. And it’s good to have metrics to measure success (e.g. customer satisfaction), but I just get a sense of a lost opportunity in here somewhere (read: you can and should do more if it makes biz sense for BofA). I hear an awful lot of focus on doing tiny details the right way, which strikes me as a less productive way to approach the problem.

But anyway, I really appreciate you jumping in here. It’s cool to get your take. Thanks.

jean_pierre 14 Jan 06

First Republic Bank’s online bill pay only exposes the pay date, not the date the payment is sent (should the user ever be tasked with determining that?). it is only fitting that their corporate slogan is “It’s a pleasure to serve you”…

Chris Kampmeier 23 Jan 06

Bank of America has just changed their payment system to ask for a “Deliver By” date, and will not debit the money from your account until it’s credited to the payee, resolving the issues raised here.

I wonder if this post was responsible for this?

Here’s the announcement from BoA:

“Bill Pay just got better. You’ve helped make Bill Pay #1 among online banking service. As our way of saying thanks, we’re making it even easier for you to use. With our simplified scheduling, just tell us when you want your payment delivered and we’ll see that it gets there on time. Even better, funds can stay in your account longer-since your money remains in your account until the payee receives the payment. Select the Bill Pay & e-Bills tab to start enjoying these Bill Pay improvements today.”

Fred Mclees 17 Feb 06

As I see it now the online bill payment took a turn for the worse with the new changes.

Since the funds are no longer taken out when the online bill payment is processed we now have outstanding payments that must be written down just like writing paper checks.

Further there is no way one can see what payments are outstanding, i.e., not withdrawn from our accounts forcing customers to write down payments into my check register like the old days.

We should have been given the option to either opt for the new method or stay with the old one. I preferred the old one as I don’t normally write paper checks and could always go online to check my balances. Now I really don�t have a clear idea as I didn�t write down my payments in my check register assuming all bases were covered by BOA.

If this change was instituted to obtain over limit fees, I suspect that is what it will do because now we are back to square one, just like writing checks and keeping track of them.

I see no other recourse than to look for a new form of online payment. It is sad because I used to brag about how good this service was; now it’s the opposite.

Further to this, this change has taken the simple task of paying bills and returned it to the dark ages of writing down our online bill payments in a check register and balancing checkbooks again. Argh!

IF YOU AGREE WITH MY COMMENTS PLEASE WRITE BOA, I HAVE!