Remember the Flip camera? From its premiere in 2006 until the business was sold to Cisco in 2009, the little video recorder was killing it. Lavish praise, booming sales, flying high. And then cell phones got good enough at recording video, and that was the end of that.

If you disregard the acquisition proceeds, was Flip a terrible business? Well, that depends: Were they taking profits along the way?

There’s no natural law that states all products and services must endure forever and always. Some companies are glorious sprints, others are slugging marathons. Both can work, but the former is especially sensitive to making money along the way.

The problem is that everyone thinks they’re going to run a spectacular marathon in technology these days. There’s no amount too great to be invested in future growth, because the future is infinite, and you’d be a fool not to capture as much of that as you possibly can.

But what if the time allotted to your capture looks more like Flip? What if your product is going to have a great, booming run, but not for the next 30 years, just the next five?

Case studies: Dropbox and Evernote

Two companies come to mind when I think of Flip: Evernote and Dropbox. Both have had tremendous success with users, both were seen and perceived themselves as “long-term sure bets”, and both are starting to look a lot less shiny these days.

Both Evernote and Dropbox are facing increasing indifference from customers and competition from simply Good Enough features in someone else’s more complete offering. “You’re a feature, not a product”, as Steve Jobs famously dismissed Dropbox (see The case against Dropbox and Evernote, The First Dead Unicorn for but two deeper analyses).

I bet you that neither heeded the lessons of Flip. I bet you that both thought they were going to be around forever, so no amount of investment in the future would be too great. I bet you that even the mere suggestion that they should be taking profits during their first, seven fat years of prosperity would have been laughed out of the boardrooms.

Don’t put it all on growth

A lot of business administration is about managing risk. Thinking about how things might pan out if you’re not as clever as you think you are, or as lucky forever as you currently seem.

Yes, investing in growth when you got a good thing going is smart. But so is thinking that you might currently be enjoying the very best years of the business, not just “the beginning of an amazing journey”.

The smart choice is making sure you win in both cases. Don’t just keep putting it all on red and rolling. Eventually, everyone’s luck or skill runs out, and then it’s awfully nice if the entire time spent playing wasn’t all for nothing.

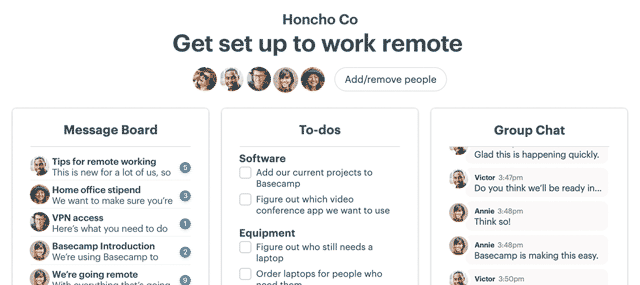

Check out what we’re up to at Basecamp.com.