There are many good reasons to be concerned about whether the internet industry is in another bubble. Once shaky, unproven businesses hit the NASDAQ, the chance that granny is going to lose her pension fund goes up big time. That’s the direct economic consequence that you’ve probably heard already.

What hasn’t been discussed as much are some of the secondary effects that a bubble has on the industry. Like how it gets harder to hire good people as a consequence. Sure, you may have heard of The War for Talent, but it’s much deeper than that. This is not simply about the latest tech darling not being able to find programmers in the Valley.

When bubbles inflate as fast as the most recent one, support infrastructure can’t cope. There just aren’t enough programmers, designers, operations people, and other warm bodies to man all the hot air balloons. So you have a predictable effect: Rapidly increasing demand for an only steadily increasing supply. Thus, inflation.

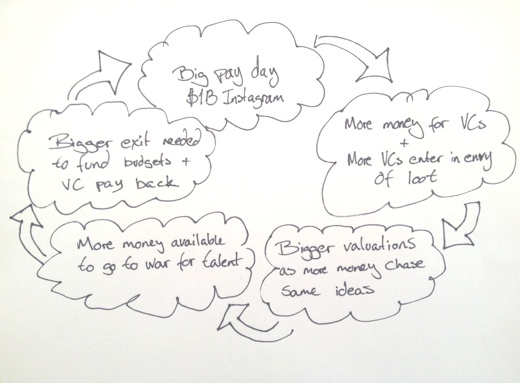

All this new demand is being fueled by the endless flows of cheap cash being pumped into the Valley (and everywhere else it can go). So the circle goes like this:

And every time we do a round, more talent gets trapped in the bubble, chasing things that can be flipped for the most money. Now in theory this is all good and well. Resources are allocated to the pursuits with the most economic value. So if Instapintora is worth $2 billion, of course they deserve to be able to hire 1,000 web builders, right?

That’s the same argument you’ll find for bridges to nowhere and other pursuits void of inherent economic and public value. Sure, people are being employeed, money is changing hands, but come Monday morning, the hangover is that we spent a bundle to build a lot of shit that’s not going anywhere.

As a result, we missed out on doing other worthwhile things. All those smart and talented heads, and all those benjamins, didn’t progress the economic base in a way we’re going to care about tomorrow. And that’s a damn shame.

George Morris

on 17 May 12There isn’t much to add to that other than an “Amen brother”

Dmitriy Likhten

on 17 May 12This is both good and bad. The good news is that programmers, like factory workers, are the backbone of businesses, but unlike factory workers, they are rare and thus the business and development become more symbiotic than parasitic.

The bad news is that programmers are getting paid ridiculous amounts. With good reason, a few good programmers can change entire industries. The down side of this is that starting a business has and will continue to have a VERY high entry cost, because unless your partner is a programmer, you will have a very hard time hiring one for cheap who is effective. Fortunately many programmers at some pay level don’t really care about the money and focus more on good fun work rather than extreme pay.

Mike

on 17 May 12Great post! One similar but smaller problem that this bubble is creating is an excess of incubators run by rich people (not necessarily experienced startup people) in less “developed” tech cities. These incubators are making investments on quantity not quality. When these incubators fail, they damage a lot of energy and relationships in the process. I’ve seen it first hand and I regret what it did to our community.

Mosaic

on 17 May 12It is tough being a bootstrapper and seeing these people raise millions of dollars for ideas that obviously won’t generate any revenue – not that I would have any idea about how to go about raising money like that, but it’s tough when I have to spend 70% of my time doing billable work for clients, and then tell myself “this will all pay off… someday.”

Anonymous Coward

on 17 May 12There’s no ‘War on Talent’. There’s a ‘War for Talent.’

Anon

on 17 May 12If you were a programmer or more succintly not a business owner you would be very happy.

DHH

on 17 May 12Anon, I’m sure some construction workers would have loved if that bridge to nowhere had come through too.

Mike Cane

on 17 May 12On the surface, that sounds good but no, I think you’re wrong. All the things that were tried, all the things that were learned, add to the cumulative knowledge that can be used tomorrow. You have as much of a Payoff Mentality in this post as the mentality you’re decrying.

Henry

on 17 May 12@DHH

Everything you are complaining about is what makes USA (and capitalism for that matter) so great.

Said another way: you are worth exactly what someone is willing to pay.

If that means someone is willing to pay some inordinate amount for (1) a company like Instagram, or (2) VC giving money at crazy valuations – that’s all okay.

Because in capitalism – we also allow for failure. Failure that if those individuals who to us are paying an inordinate amount for a company, doesn’t pan out – they will fail (and lose their money).

So what’s the issue here?

You should embarrass capitalism since it’s been a huge driving force in while living and working in the USA is so great.

Luke van der Hoeven

on 17 May 12This is why I think Jeff Atwood’s “Don’t Learn to Code” article was right on.

Ken

on 17 May 12Amen. I have to say, the period in the last 15 years I enjoyed the most was actually after the last bubble popped. The first year or two were really rough. All those high-paying jobs evaporated, and assuming you could even get one, it generally meant a healthy pay cut. But the longer-term result was that it shook out a lot of the people who never belonged in this industry and what was left was much more sustainable. Now, I’m seeing the exact same cycle happening. Competition for talent (and resources like housing) have driven wages way up. It’s attracting people it might not otherwise.

I’d love to start a company, but now is really a terrible time. There’s lots of funding, all chasing the same unicorns. If you want to bootstrap, I say wait for the crash. Everything will get cheaper. Rent. Infrastructure. Talent. Even the assets of other companies that failed. The only thing that will be hard to get is VC, and that sounds like a benefit.

David Andersen

on 17 May 12Well Mike Cane, than this bit of information is part of that whole “all the things we’ve learned” too. And humanity tends to forget its lessons over and over and over again. It will continue to pour money down a rat hole every so many years (tulip bulbs, beanie babies, 750k shacks in California, etc.), probably forever. Nothing wrong with pointing out the waste.

Paul D

on 17 May 12Its lottery economics. The last bunch to hit was Google.

People see a relatively small number of people cash in for billions, and this begins a round of lottery ticket buying (VC funding)... most are worth nothing, but a very minute number are worth an extraordinary amount.

This country is starting (?) to rely on bubble economics. Extraordinary payoffs to a handful, and near total losses to 98+%. It is a landscape of incredible risk, and outrageous rewards.

Rest assured, this will lead to stratified caste-system economics in the US, a tiny billionaire class and the vast unwashed. The middle class, the engine of this country for 100 years, will die.

Bubble economics isn’t just a curious phenomenon, it’s the end of this country as a economic power. We will be also-rans like the Egyptians, the Romans, an the English. Colonial powers with horribly skewed wealth… that’s the death knell for all great economic powers.

David Andersen

on 17 May 12Henry, there’s a difference between allowing for failure and warning against it. Just because we allow it doesn’t mean we prefer it, especially when valuable resources are wasted in the process.

Anonymous Coward

on 17 May 12and on another note, would you like to buy a declining revenue base for $480,000?

Paul D

on 17 May 12“Everything you are complaining about is what makes USA (and capitalism for that matter) so great.”

I agree to a large extent, Capitalism is about the best system for economic progress ever devised.

But something has gone terribly wrong in recent years. It’s this:

“Because in capitalism – we also allow for failure. Failure that if those individuals who to us are paying an inordinate amount for a company, doesn’t pan out – they will fail (and lose their money).”

This is exactly what we are NOT allowing to happen anymore, circa 2008. “Too Big To Fail” is the most anti-capitalist thing ever conceived. It should be renamed TOO RICH TO FAIL, or TOO POLITICALLY INFLUENTIAL TO FAIL.

We are not operating in a capitalist system anymore. Failures are bailed out. The rich are allowed to fail with taxpayer money. From $9 trillion to $14 trillion in months. That’s the losses that were recouped to the hyper-wealthy. We are encouraging multi-trillion dollar bets with the promise that all losses will be heaped on the American middle class.

Off topic? Hell no, this Bubble Mentality is at the root of all this. It’s a Narcissistic mindset that has practically overwhelmed the planet. The Greeks have VOTED to default on their debts. They VOTED for it. They will default on hundred of billions of euros. It will spread to Spain… man, then it will truly get weird.

Without bias, look at the true source of bubbles, and you will find out-of-control selfishness. We encourage in our populous, we practically demand it in our politicians, and then we vote that it be sustained beyond all rational means in our bailouts of everything.

It’s a social cancer. Bubbles should be allowed to pop CATASTROPHICALLY. Or they will return, and no lessons will be learned. The lesson from the last bubble: GO HUGE, cuz you ain’t gotta cover any losses.

Anon

on 17 May 12David, many are not bridges to nowhere, Twitter is meaningless to me, but many users find it entertaining. Programmers are resources as are construction workers ‘cold hard reality’, we are not part of someones grand vision and we typically do not share in the rewards, nor should we as our risk is minimal in comparison, it is a marketplace and resources will go to those wiling to pay the most. I agree with you on the other points.

Duff

on 17 May 12I see these technology bubbles as society digesting the huge productivity advances that technology advances have brought to the table. They are a healthy thing.

Existing players in the market are not going to drive their products forward if there isn’t a sufficient return on investment for them. Hence, you have a dozen startups working on web applications that generate invoices. Is invoice creation a viable business? Maybe, maybe not—but at a minimum, these startups are going to advance the state of the art forward.

The problem, from my POV, is that with the potentially huge amounts of money floating around, we can collectively end up with a corrupt system where insiders distort the market to their personal benefit. The sad state of Groupon is a good example of this.

Capitalism, or the ability to walk away from losses via bankruptcy aren’t “the problem”. The core concept of the “free market” is that it is free. If business leaders are throwing around billions of dollars for whimsical or nefarious reasons like suppressing new entrants into the market (cough Instagram cough), you’re not really embracing capitalism in a real sense.

Lucas Stephanou

on 17 May 12A side question: Is 37s losing people?

About the text itself: Agreed and I go a step further, this phenomenon can be summed with your last paragraph. At the end of the day(round) we(as humans) are spending much effort in things that do not add concrete value.

One can think that is because our field is new(IT), but it’s time to people realize that we need to be more mature and stop creating bubbles ‘cause a lot of teenagers think that every new coolest thing should be the most important thing on Earth

pwb

on 17 May 12It’s pretty easy to critique the supposed bubble but I think discounting Instagram, Pinterest and Quora is lame. These are actually pretty decent properties that delight (in a reasonably good way) lots of people.

Edwin Nathaniel

on 17 May 12I think it’s kind of interesting to point out that Rails may actually have a big helping hand in building this bubble economy.

http://www.inc.com/jessica-stillman/the-fast-track-to-start-up-life.html

I don’t mean to ridicule Rails or you, DHH. But I just find it interesting.

Fuzz Leonard

on 17 May 12I had an interesting experience with this War for Talent. I left the west coast early this year to take care of some business on the east coast. Then I decided to back to the Bay Area and experience all the crazy energy of the bubble. I spoke with over a dozen companies, all of them falling all over themselves to hire me. Until the moment they found out I was not in the Bay Area, at which point I never heard another word. I was not asking for paid relocation, I just didn’t want to move out until I had secured a job.

After this happened more than a dozen times I said, screw ‘em, and started looking locally. I had two job offers by the end of the first day.

My experience may be unique, but from where I sit it is more like The War Against Non-Local Talent, along with its sister campaign, The War Against Telecommuting (aka ZOMG YOU HAVE TO BE HERE FOR THE DAILY SCRUM!)

James

on 17 May 12@Henry

That’s a very naive (and possibly dishonest) way to describe how capitalism works. To say that capitalism allows for failures, particularly in USA, is right out trolling, at best.

Mike Cane

on 17 May 12@David Anderson: And you missed the point entirely. Tulips and Beanie Babies have nothing to do with this. People learning new skills, increasing their value and knowledge, is never a waste. Just because there is no payoff now is no reason to say it’s all some gigantic “waste.”

William Morrison

on 17 May 12This article confuses cause and effect, and makes a terrible comparison at the end.

The reason we have a bubble is because government likes to build bridges to nowhere. Rather than letting the economy grow normally, the government is buying political power by passing bills that require a lot of spending, and then funding that spending by printing money, which creates a great deal of money sloshing around the economy. That money ends up being put to use to finance economic growth.

The allocation of resources in this way by the private sector is not really that bad… it is certainly of no comparison to bridges to nowhere which are pure wastes of money built to accrue political power.

The social cost of all this is that the monetary inflation devalues the dollars of all other businesses and thus it works as a transfer of wealth from the many to the hands of politicians and big banks, and secondarily VC funds etc, who are able to have easy access to the government money spigot.

Shut off that spigot, cut spending, and you’ll quickly see the economy return to normal growth—and that growth will actually be faster and better than what we have now (since so much of the nations resrouces are redirected to bridges to nowhere.)

Thus you miss the cause and blame the effect.

Phil

on 17 May 12I very much agree that we’re in another tech bubble.

Why did we end up here so soon? Less than a dozen years since the last one popped. After the first tech bubble popped we got the housing bubble. Around 2005, 2006 a huge amount of money was being thrown at real estate (“because real estate never goes down” right?). Not only money, but talent as well: I knew who quit their engineering jobs and got into flipping houses or hawking loans because the payoff was much bigger.

Then of course, the housing bubble popped leading to one of the biggest (if not THE biggest) financial crises since the Great Depression of the 30’s. The solution? In the US the government bailed out some of the biggest causes of the housing bubble. The Fed lowered interest rates to effectively 0 as well as buying toxic assets thus putting a value floor under them. And so we’re back in an easy-money economy. Capital is looking for a higher return. Some of that capital seeking a higher return is flowing into stuff like FaceBook and Instagram. Nobody’s saying that Instagram isn’t useful to someone, BTW, bit is it $1B worth of useful? In an easy money environment lots of bad investments are made.

What we really need right now is some way to improve transportation (making it much more efficient), we need ways to improve our physical infrastructure and we need to develop more environmentally-friendly ways of producing things. Better energy efficiency, etc. But the best and brightest minds of our generation are being employed by the likes of Goldman Sachs to figure out how to cut a microsecond off of trading times. Or Google to tweak various algorithms for increasing their advertising revenue. Or Facebook to figure out how to get more people to… use Facebook, I guess. Not that these things are bad in themselves, but compared to the huge challenges we face (global warming, peak oil, environmental degradation, a failing healthcare system, etc. ) they’re pretty insignificant.

As for @Mike Cain’s comment above about people gaining skills during this time: if history is any indication, when this bubble pops it will be a few years until a lot of those folks get to ply their trade again, and by then things will have change enough that they’ll need to retrain anyway.

Chris

on 17 May 12@DHH

While what you say is mostly true, there is good news. The engineers “trapped” are only going to be trapped long term in companies that don’t go out of business. The Pets.coms of this world don’t keep them trapped too long. Fortunately, the companies that seem to do things best like Google, Apple, etc. are rewarded and the hype turns out to be grounded in reality.

What’s the alternative? Often I see some form of “mastermind” proposed (either through some sort of cult of personality or through the force of government) who can make the 5 year plans on what’s useful and what’s wasteful… that never works out.

Crowdsourcing decisions like ‘where to put our effort?’ seems to work best, and the best crowdsourcing measure of success seems to be money. Another name for “crowdsource voting with money” is “capitalism”.

Adrien Lamothe

on 17 May 12The situation is nothing more than a natural consequence of a society where the top 5% control ~ 90% of the wealth. It doesn’t matter whether the bubble pops, the top 5% will always skim the cream off the top day-in and day-out 25/7/365. If some pension funds get caught up in it too bad they had no business getting involved. Stocks are inherently worthless unless you are trying to get a board seat and some control of a company, otherwise they are just pieces of paper. It is very humorous to witness so many people who have been brain washed into thinking otherwise.

Phil

on 17 May 12@Chris: The problem is that what we have now is some sort of mutation of capitalism. Why has the financial industry (GS, JPM, etc) still been hiring lots of very talented new graduates to work on their trading platforms? Because a huge chunk of that industry got bailed out by the government. Why is the emphasis now still on debt-based spending when saving would be a more prudent way to build up our capital base? Because the Fed has a 0 interest rate policy that punishes saving and rewards more debt.

Why are we putting $1B into an Instagram when a similar investment into basic research would pay more dividends in the longrun? Because our capitalism rewards very short-term thinking and quick payoffs. Maybe this is an actual fault with the capitalist system? Maybe it’s not able to respond quickly enough to threats like peak oil and global warming?

We used to have Bell Labs doing all kinds of basic research. Without Bell Labs it would have taken a lot longer to develop things like the transistor. We wouldn’t have Unix (or Linux or OS X). There’s a huge list of things we wouldn’t have now (or we would have gotten much later than we did). Where is the Bell Labs of today? We don’t have one. What will that mean for the future? How was Bell Labs able to do this? It had a long term mindset. How was Bell Labs able to have that longterm mindset? ATT had a government-granted monopoly which meant that Bell Labs didn’t have to worry about profits in the next quarter. So there you have it. Pure capitalism didn’t give us Bell Labs. Yet if Bell Labs hadn’t existed there’s so much we would not have right now. Of course, that monopoly had to eventually end – if it hadn’t ended we probably wouldn’t have things like smart phones now as there would have been no competition in that space.

All that to say that there are other forces besides capitalism that have driven our technological and economic development. The space race of the 50s-70s also had a huge impact on technological & economic development and that was all driven by governments.

h

on 17 May 12d

Anonymous Coward

on 17 May 12Allowing for fail is not the same thing as celebrating failure. A

And allowing for fail in the individual/company level should not mean we allow for fail in the collective level.

A bubble is not a company that tries but fails. A bubble is thousands of companies, and millions of affected individuals. In that sense, a bubble is like a whole economy sector failing.

@Paul D

Off topic? Hell no, this Bubble Mentality is at the root of all this. It’s a Narcissistic mindset that has practically overwhelmed the planet. The Greeks have VOTED to default on their debts. They VOTED for it. They will default on hundred of billions of euros.

Sorry for the continuance of the off-topicness: (speaking as a Greek) This “default” is exactly what you ask for on your first comment. The Greeks opted for a default (with means bankruptcy) VS the continuance of the bailout plan. I.e they’d rather default than have their debts bailed out by E.E/IMF.

Not there’s a long and convoluted history behind all this, but you won’t find it on any mainstream english-speaking media.

Here’s a quick analogy: with the US national debt being what it is, consider the case that money lending institutions decide to feast on the US, and refuse to lend US any money except with ominous terms and huge interest rates.

Now, the US cannot pay it’s debts, so it can either default, or ask for help. They ask for the help of the IMF, which lends them money (so adding debt on debt), but with provisions such as firing half the federal government, cutting down wages across the public and private sector, defense budget, etc. They decree that workers are not competitive enough, so salaries must fall to Mexico levels. They even add specific rules that say they if the US fails to pay them (the IMF), they will take public assets, including national land.

Would you consider such a deal acceptable or even viable? Would you consider a bail-out that piles debt on debt as a solution preferable to flat-out bankruptcy?

Would you accept insults from a country that coordinates this “bailout plan”, when the same country, 6 decades ago, invaded and killed 300,000 of your citizens, and even wrote (via their appointed occupied forces government) a loan to itself, equal to 1/3 of your current debt, that they never repaid? Add to the analogy, that that country controls your currency system, and not you, and has for a decade or more been taking advantage of it to benefit itself and not all the countries participating in the same currency.

Brade

on 17 May 12Agreed with DHH, and hella agree with Paul D. Nuff said.

Platypus

on 17 May 12When people are paying their own hard-earned money, the “worth exactly what someone’s willing to pay” argument works. That kind of capitalism is a great system. When people are paying more than they should even have, because it’s other people’s money mostly derived from rent (in the economics-textbook sense) rather than genuine wealth creation, in a legal environment that prefers those who contribute capital over those who contribute labor, not so much. Then it’s just a way for the already rich to launder their unearned wealth through a few companies (that in the case of Instapintora etc. are clearly little more than shells) before getting it all back with interest, perpetuating and even accelerating the anti-productive cycle.

Mike

on 17 May 12Why do I find it hard to believe there’s a ‘shortage’ of programmers? Pretty much every major university pumps out tonnes of CS grads all the time – I find it hard to believe any tech company is truly short of developers.

Mike Cane

on 17 May 12Maybe so, maybe not. Some people have spoken out about ageism in tech too. Depending on how reputable your startup firm is (that is, is it a BubbleCo or not?), would you rather get a bunch of inexperienced people or people who have massive experience and can bypass the mistakes the inexperienced ones are bound to make?

Also, even though I agree there’s a bubble, it’s not like VCs are going to stop investing, period. If that was so, we wouldn’t be having Bubble 2.0 going on here. The number of investments will drop, but they’ll start ramping up again—because where else is the money going to go? Into a shaky bank (and most are shaky today)? Into real estate (which continues to depreciate)? Into gold (which regularly gets hammered down by coordinated international government efforts)? Barring some manufacturing resurgence due to some nanotech breakthrough, tech is all we’ve got for VCs.

Dylan W

on 17 May 12And in the end you own http://jobs.37signals.com… lol, don’t cry too hard.

Dylan W

on 17 May 12and yes, I agree with you. =]

Spicer Matthews

on 18 May 12The tech bubble is sort of a funny thing in terms of programmers. I bet headlines like Instagram selling convinced a few more people to study Computer Science instead of another major that might be in less demand.

As an industry we are needing more talent. So a bubble might bring more attention to the computer industry. My hope is now-a-days should there be a burst of the bubble more stable companies (ie. Apple, Google, Facebook, and so on) will be around to pick up the left over talent so our unemployment lines do not grow.

For good or bad bubbles bring entrepreneurship to everyone’s minds. I am sure there has been a few great companies started from the added confidence of a tech bubble.

I mostly agree with David that this cycle of money is crazy and not helping, but there are some good bi-products. It is not all bad.

James

on 18 May 12I don’t think internet companies are going nowhere :)

Joe

on 18 May 12@Henry says “that if those individuals who to us are paying an inordinate amount for a company, doesn’t pan out – they will fail “

Get a clue man. When is the last time you have ever seen an individual “fail” due to a company’s failure? Never. Between corporate bankruptcy protection (company fails, my shareholders lose it all, my vendors lose it all, my employees are on the street, but I keep my fat paycheck and bonus) and government bailouts, those individuals with the most to gain also have the least to lose.

It really is fundamentally broken.

David Andersen

on 18 May 12No Mike Cane, I didn’t. I’m talking about the price paid for those programmers, which is a waste, and the time spent by those programmers on efforts that will probably prove to deliver no value (outside of whatever those programmer’s learn). Sure, those programmers will learn things; that’s usually given and that’s not the point. The point is that they could be doing their work and doing their learning on something that is of utility to the greater world while costing less to do it. You’re looking at this from one point of view. No one has argued that it’s 100% a wasted effort, just that it’s a horrible misallocation of resources.

Fm8 tutorials

on 18 May 12Nice post… And this has a similar resonance

http://www.wired.com/epicenter/2012/05/angel-no-more-why-one-of-silicon-valleys-savviest-investors-has-shut-his-wallet/

Joe

on 18 May 12I agree with DHH. We’ll invest $16 billion to Facebook, yet when it comes to education, health care, science, arts, infrastructure, and any other number of fields by which the progress of a civilization is measured, there’s suddenly no money available in “this economy”. And that’s a damn shame.

Marc Gayle

on 18 May 12DHH, While I tend to agree with much of the stuff you write, I think you are off the mark a bit on this one.

For starters, even if there is a ‘bubble’ now (which I am not arguing against), the net effect is that more people are becoming interested in tech at an accelerating rate. You might see that as a bad thing, but I don’t think it is.

The more developers are chased with high-paying startup jobs, endless stock options and other equity is the more they will feel inclined to improve their craft. One bi-product of developers getting better is innovation. We are lucky enough, in the web industry, that a large chunk of that innovation tends to end up being open-sourced.

The more innovative open-source projects (whether it is a real-time client-side web framework, or the latest framework that claims to run web code natively on all mobile devices) is the better off we are – on a net basis – even if the vast majority of those languish.

The more new tech that gets invented is the more likely current developers are to create ‘user-friendly’ tools for existing developers and non-developers. The more that happens is the wider the net that gets cast that will encourage non-developers to get interested in development…which creates opportunities for new developers (e.g. people can sell training to those non-developers). That creates a virtuous cycle where people that didn’t know they would be kick-ass developers end up being kick-ass developers which leads to more innovation, driving down the costs of technology and lowering the barrier further.

After the 2000 bubble burst, many were shell-shocked…but I would argue that the vast majority of those that were shell-shocked were not those that truly understood tech. It was grandma that bought Pets.com because it had a ’.com’.

So yes, we may be in a bubble….yes it does lead to wage inflation (which, would actually be a good thing for the world economy right now) and yes there is hysteria around these $1B exits. That being said, as someone that lives outside of the echo chamber of the valley (Jamaica to be exact), the net benefits that I accrue are pretty substantial – as a result of this ‘bubble’.

These large exits also add credibility to those of us stuck in economies and societies that see tech as the IBM mainframe that powers the LAN of their companies….we don’t look so weird when we asked what do you do, and you say ‘web development’. They now go…oh…did you hear about Instagram? with a twinkle in their eye

dstroma

on 18 May 12Central banking polices such as the Federal Reserve’s current 0% interest rate (to remain so until 2014 no less) are the #1 source of bubbles and malinvestment.

Peter McFarlane

on 18 May 12The UK economy is in deep trouble. At the same time, the top 1000 wealthiest people are worth 122 Billion which is more than enough to clear the national debt, and at least 700 of those people are directly involved with the businesses and institutions that actually helped cause the latest crash.

Anonymous

on 18 May 12You might be interested in doing some reading on the Austrian Business Cycle Theory as it addresses and deconstructs some of the very issues that you’re observing such economic bubbles, misallocation of capital, malinvestment, price inflation of certain capital goods (in this sense programmers can be considered a “capital good”) and the sources of these issues (which is typically central bank monetary policies.)

Anonymous Coward

on 18 May 12Too many people in SV (and America) have too much spare money.

Quick Heist

on 19 May 12Tech start ups are a form of legalized embezzlement. Check out the ‘High Tech Start Up, Silicon Valley Style’ and ‘High Tech Start Up, New York Style’ scenarios at http://quickheist.net. Quick Heist is one of the few, if not only, games done in Ruby on Rails.

Thomas

on 19 May 12Bitter…

Breckenridge Real Estate

on 21 May 12This is too true – especially in the internet/tech industry. The internet isn’t going anywhere, either, so it’ll be interesting to see how this “inflation” effect works itself out in the future.

TJ

on 21 May 12Sadly this is becoming more and more commonplace…

Cindy Wu

on 23 May 12I think this is a good news for the talented Computer programmer.

Pierre Bastien

on 23 May 12Maybe instead of trying to prevent bubbles we should just budget for them.

This discussion is closed.