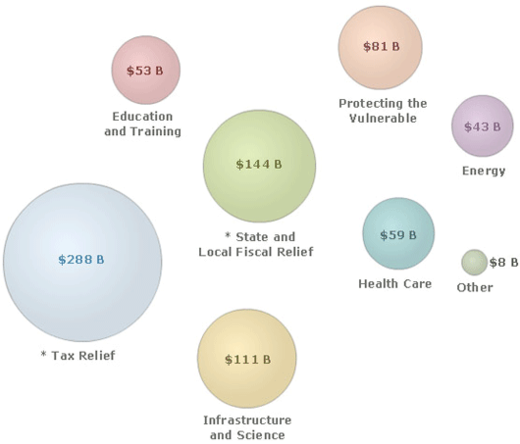

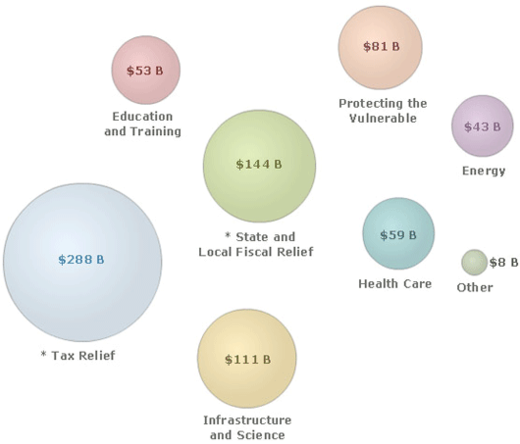

“Where is your money going?” from the new Recovery.gov site. The numbers are so big that $8 billion is a small circle simply labeled “other”. I also like how the image name is investmentbubble.jpg.

You’re reading Signal v. Noise, a publication about the web by Basecamp since 1999. Happy !

“Where is your money going?” from the new Recovery.gov site. The numbers are so big that $8 billion is a small circle simply labeled “other”. I also like how the image name is investmentbubble.jpg.

Levi

on 18 Feb 09“Investment bubble” is a bit too ominous. Why don’t they just name it road_to_hyperinflation.jpg

Tony

on 18 Feb 09For all the complaining about this bill, I’m actually really stoked. It’s unfortunate that the economy is in such a hole, and the spending here probably isn’t enough to counter-act the deflationary spiral and credit contraction that’s occurring, but maybe this can be a catalyst for some much needed investment in the commonwealth of our country. I’m sure the hardcore anti-government conservatives out there cringe when they hear that word: “commonwealth”, but I think it’s great that some of our society’s core services are owned and/or administered by government (fire, police, freeways, parks, national parks & forests, public education). Congrats Obama!

(If you disagree, as I’m sure some of you do, please respond intelligently rather than just starting a flame war)

GeeIWonder

on 18 Feb 09investmentbubble.jpg

Yikes. I’d change that ASAP, as bubbles usually imply a forthcoming pop.

Good catch!

Tony

on 18 Feb 09Levi: it’s my understanding that with federal interest rates at almost 0%, and the economy contracting as it is, the concern of most economist right now isn’t inflation, but rather deflation, which is potentially more dangerous. Inflation isn’t likely to result from this stimulus package, largely because it doesn’t even fit the gap of our falling GDP. But if inflation were to start become a problem a few years from now, it’ll probably be due to rising demand and the economy returning to normal, and in that case the fed can start raising interest rates back towards more normal levels.

Taylor

on 18 Feb 09WTF do these categories mean?!? Protecting the Vulnerable. Seriously. If the administration wanted to truly be transparent, they would show a specific line-item break down.

Most glassy-eyed Americans will praise the President for taking “pro-active” steps to save our economy. Horsesh*t. The bailout is an irreversible move that will put the country further in debt and take years to see the effects.

Devan

on 18 Feb 09Here is another chart looking at the apportioning of the stimulus package – a bit more detail…

http://www.washingtonpost.com/wp-dyn/content/graphic/2009/02/01/GR2009020100154.html

Andrew

on 18 Feb 09Jeez, 1/2 of it is just pure handouts (including the tax cuts), i see moderate stimulative effect in the infrastructure and science bubble, but pretty much everything else is simply a left-wing wish list (like the patriot act was a right-wing anti-criminal wish list). we’re hosed.

zac

on 18 Feb 09“Inflation isn’t likely to result from this stimulus package, largely because it doesn’t even fit the gap of our falling GDP.”

Inflation has almost nothing to do with GDP and almost everything to do with the money supply. According to Milton Friendman inflation is purely a monetary phenomenon; it is caused by the money supply growing faster than its use.

Also, as noted above, it couldn’t be any more unclear where the money is actually going, because the reality is its going places that’ll tick you off. All spending is not created equal, and this spending will not be nearly as effective as the private spending it is crowding out.

David Andersen

on 18 Feb 09Tony,

This is hardly the place to have a discussion about economics and federal policy, but I humbly suggest that you broaden your horizons and deep dive into some non-Keynesian viewpoints. Try Milton Friedman, Walter Williams, and Thomas Sowell.

David Andersen

on 18 Feb 09As far as the chart goes, I’m hard pressed to think of anything more useless. If I presented such a chart in my line of work I’d be laughed out of the room. It means nothing.

John Dilworth

on 18 Feb 09My favorite part is the page before where the graphic is a bar chart. When you click the “Learn More” link, you get the bubble graphic, which doesn’t actually provide any more information.

It seems like a weak effort, and an obvious attempt to dumb down the information for us.

Tony

on 18 Feb 09David Andersen: Thanks for the suggestions. I’ve looked into Friedman before, but not the other two. I’ve heard that the main non-keynesian approach to stimulate growth was via the federal reserve interests rates, and that approach is now exhausted since it’s at 0. What would those economists suggest we do now as an alternative? Taxcuts?

IamPersistent

on 18 Feb 09I just looked at the Washington post chart and I’m left wondering, what in the hell does most of the bill have to do with stimulating the economy?

I swear, the people that WE THE PEOPLE have put into office have a burning desire to spend OUR money, finding any convenient excuse possible. And don’t get partisan here, its both Rs and Ds that do it (remember the earmarks, oh we don’t call them that now, in the cough “bailout”).

Alex P

on 18 Feb 09Talk about terrible information design… It’s well known in the vusalization world that people are terrible at evaluating numbers based on views of area. If anything, this makes the difference between 288 billion and 8 billion look considerably smaller than it really is.

Duckie

on 18 Feb 09All i’m wondering is how these bubbles relate to the ‘war and killing innocent people in a huge sandbox’ bubble…

Paul

on 18 Feb 09For those of you looking for more info, the FAQs spell it out:

All in all I’m impressed with the site – and the little timeline on the front page of recovery.gov is a nice touch. I believe this is the first time the word “mashup” has ever been used on a .gov, too (note the last FAQ.)

Keith

on 18 Feb 09@Alex P – Thank you. Finally someone is willing to say that publicly.

Eadwacer

on 18 Feb 09@AlexP and @Keith, at least they are using comparable areas, and not diameters, as a Wall Street chart of a few weeks back did. But probably a pie chart would have been better, particularly that the topic is, how are we dividing the pie.

Steve

on 18 Feb 09Of course you left out the explanation of the * found on the main website which shows how much you can hide with ‘simple’ information layout

Tax Relief – includes $15 B for Infrastructure and Science, $61 B for Protecting the Vulnerable, $25 B for Education and Training and $22 B for Energy, so total funds are $126 B for Infrastructure and Science, $142 B for Protecting the Vulnerable, $78 B for Education and Training, and $65 B for EnergyAnonymous Coward

on 18 Feb 09“Protecting the Vulnerable” – if that isn’t duckspeak I don’t know what is!

David Andersen

on 18 Feb 09@Tony -

Briefly, they’d advocate, as you will read, that the government has no place ‘stimulating’ the economy. That for the government to spend money it must necessarily remove money from the private sector. That government does not have much of track record picking winners and losers – it distorts the allocation of resources. Why do we think that a few hundred people know better how to allocate 800 billion dollars than the population as a whole making millions of individual decisions? If you had an extra $2500 (roughly the per capita split of this bill) how would you use it? Whatever you’d do, would it not stimulate economic activity? Even saving it makes more capital available for lending. Finally, the economists I cited will, above all, claim that individual liberty should be the trump card in all of this – something sorely missing from the statist nature of this bill.

Mike Beam

on 18 Feb 09@David Andersen

Thank you for saying this. It can’t be said enough.

Dave

on 18 Feb 09@Andrew Tax cuts are not hand outs. Taxation is legalized robbery which the State has a monopoly on. Tax cuts, are nothing more than “not robbing”

It’s all a zero sum game. To give a dollar, the State must either steal a dollar through taxation, borrow a dollar (and pass the bill to our children), or print a dollar (which makes existing dollars worth less).

Dave

on 18 Feb 09@David Andersen, re: the “statist nature of this bill” – right on.

@Tony The “approach to stimulate growth .. via the federal reserve interests rates” is actually part of the Keynesian view. More generally, Keynesians advocate a centrally planned monetary policy under the control of a central bank.

In addition to the authors David Andersen cited, I’d also recommend exploring the Austrian School, in particular Murray N. Rothbard. A number of his books are available for free in audio book and PDF format here: http://mises.org/media.aspx?action=category&ID=85

Mongo

on 18 Feb 09I have to say, I’m continually surprised at the vaguely libertarian views expressed on this forum from time to time. For good or ill, it’s rather unexpected.

David Andersen

on 18 Feb 09@Mongo – why is it surprising?

Matt

on 18 Feb 09Wow…that’s a lot of dough. I was never a fan of the stimulus package, but after watching PBS’s Frontline last night…we were literally on the the brink of complete financial failure. By all means, we’re not out of danger, but heck, this may help some. I think this crisis is summed up best in Stanley Kubrick’s Full Metal Jacket. In the scene with the Captain and The Joker going back and forth complaining about the war, the captain responds: “This is one big $hit sandwich—and we’re all going to have to take a bite.”

Dig in America, let’s put our minds together and get out of this mess…together!

Chris Carter

on 18 Feb 09Digging out of this mess together is a great idea, unfortunately our government keeps bringing a backhoe instead of a dump truck. They pick up one pile of dirt only to drop it on someone else, in the same mess.

The only way to get out of the hole we’re in is to quit moving dirt and start building a ladder – through rebuilding our investment infrastructure and economy (hint: government spending is not and has never been the economy – the GDP is made up of folks like you and me spending money).

All congress and this administration has done is made a very significant balance transfer from the have nots to the haves, and stolen a good portion of that transfer from our future. Unfortunately, they are better at communicating through fear, mistruths, and sometimes even outright lies than any of the more educated people are. I appreciate the economists who have done the research, but unfortunately they’re not portrayed in the headline position on CNN, NBC, CBS, etc.

David Andersen

on 18 Feb 09@Tony – how timely, read this:

Economic Miracle

David Andersen

on 18 Feb 09@Matt, “this may help some” is an awful rationale for action, especially when it costs 800 billion dollars.

Matt

on 18 Feb 09meh, stay positive…that’s all we can do, man. No new elections for 2 years. I too, am pissed off, but being pissed doesn’t change a thing. The deal is done and now we have to be prepared to die separately or hang together. Sorry, David. :/ I didn’t like the fact we had to act expeditiously, but hey, we have elections-so vote for another candidate or build an island (those are our choices).

@Chris-You’re dead on. I’ve given up watching American news. A few years ago, I stuck to FT, The Economist, and BBC World News, in addition to the lackluster American coverage. The Sunday Talk Shows (like MTP, This Week, and GPS) are the few exceptions to American news coverage.

Michael

on 18 Feb 09@Matt, take it a step further. The Economist is a poor analyst. The FT is filled with as much rubbish as the WSJ. Britain had a bigger housing bubble than we did. You’re not doing yourself much of a favor with their perspective.

Read classic books to learn to think well, and then do your own primary research.

Tony

on 18 Feb 09David Andersen: I did some more reading on Milton Friedman, which stated the governments role in markets should be limited to monetary policy, in the form of constricting and expanding the money supply, so I still hold to the statement that using the fed’s interest rate is 100% characteristic of a non-keynesian approach:

“Friedman was the leading proponent of the monetarist school of economic thought. He maintained that there is a close and stable link between inflation and the money supply, mainly that the phenomenon of inflation is to be regulated by controlling the amount of money poured into the national economy by the Federal Reserve Bank.” wikipedia

That being said, I mostly agree with the libertarian view that government tends to be inefficient and markets tend to work better themselves… in most normal circumstances. What we’re facing right now is not normal.

The government saw what happened when they let Lehman Brothers go. It sent total panic throughout the markets. Even with their bailouts the stock market has lost close to 50% of it’s value from it’s peak. Can you imagine what what happen if the government had let Bear Sterns, AIG fail? Fanny & Freddy? If they let all these other banks fail that are essentially broke? If they let GM and Chrysler fail? How much would credit and spending contract then? How many more businesses would fail as a result? How many more people would loose their jobs? What would be the foreclosure rate then? You can call me alarmist if you want, but there are a whole lot of economists out there that were terrified by this scenario. It would have created a domino effect throughout the markets, and it would be a collapse beyond the scale of the great depression (where they did end up nationalizing some banks and intervening).

Maybe the government had set a dangerous precedent with prior bailouts, and maybe they broke the psychology behind a truly functional free market. And maybe it was government and the federal reserve that got us into this mess in the first place. But how do you at this point shift to a non-interventionist, libertarian approach, when doing so right now would be a complete collapse of the economy? Who knows, maybe that kind of complete collapse is the only thing that’s going to set this right again and revalue assets at what they should be. Sort of just wiping the slate clean and a starting over. But personally, I feel that the hardcore conservatives who are clinging to the notion that if we do nothing it’ll magically come right fully understand the implications of what they suggest.

Michael

on 18 Feb 09I failed to emphasize that I read them in addition to the usual American rags/tv.

Levi

on 18 Feb 09@Tony, I understand your concerns but the problem is that government intervention has done nothing but make the problem worse. They’re essentially pouring gasoline on a fire.

True, it would have been bad if the banking system collapsed but a banking system collapse is nothing compared to a currency collapse and that is what the government is driving us towards. They are shredding the dollar and making it worthless. Also, take a look at all the post-bailout economic numbers. I think you’ll have a hard time arguing that the government intervention has helped anything. My small business still can’t get any more credit. I thought that was the whole goal of TARP in the first place.

Bottom line: Governments cannot spend their way into prosperity. It has never happened (although disastrously attempted) and never will.

Levi

on 18 Feb 09Tooth Fairy Economics: a better, more articulate argument than mine.

Tony

on 19 Feb 09Levi: Interesting link. It helped me understand a bit more where the conservatives are coming from… it’s actually really good to see the fiscal conservatives coming back around to replace the neo-cons btw. They do serve an important role in government.

For another point of view check out this critique of critique of Friedman’s libertarian economics by Paul Krugman: http://www.nybooks.com/articles/19857

“I think you’ll have a hard time arguing that the government intervention has helped anything. My small business still can’t get any more credit. I thought that was the whole goal of TARP in the first place”

I would agree that TARP hasn’t gotten credit flowing that much to consumers. Credit is less frozen than it was, but definitely not back to normal. I’m sick of seeing public money given out to the super-rich too. But TARP was designed by the Bush administration (not intended to be a cheapshot to the GOP as a whole) and could hardly be called keynesian stimulus… although it should be said that TARP did help move banks towards solvency, and probably prevented a number of bank bankruptcies. For the banks to lend, there has to be a profit-motive for them to do so, and right now there’s too much risk for them to start lending again. Also keep in mind that TARP was a loan, not a handout. In theory that money will be repaid, unless there’s a real collapse.

In regards to Obama’s stimulus package, I guess we’ll just have to wait and see what it actually does with the economy. If nothing else, maybe it’ll solve some disagreements between these different schools of thought. Cheers.

Chris Carter

on 19 Feb 09I’d rather we actually had an idea of what it was going to do, you know, ahead of time? Perhaps if our lawmakers could actually read the bill before it goes into effect, instead of experimenting with nearly a trillion dollars, that by all estimates will be 3 trillion when all is said and done.

But no, that would require dilligence, oversight, and might actually force people to reconsider an $800 billion blank check to various special interests.

Matt

on 19 Feb 09Offer the government a free Highrise account and let everyone in America have the ability to watch how they’re spending this money.

Tom H.

on 21 Feb 09Does anyone really ‘get’ how big those bubbles are? Really. The congressional budget office has stated that doing nothing ends the recession by the end of 2009 PDF

What about the missing bubbles? The bubbles that outline debt servicing and continued spending? The cost to service this debt is estimated at an additional $744 billion, according to the CBO. This bill is nothing more than the largest, most ill advised loan in the history of mankind. The intent is solely to restructure America as we know it.

Pure theft and it will fail.

Mike Beam

on 23 Feb 09Tony: Keep in mind that the damage to the economy was done during the boom phase, which came about as a result of government intervention. The depression we are now in is the hangover from the government induced drinking binge we’ve been on since the dot-com bust. The economy has to be cleared of the bad investments made during the boom. Artificially propping them up will only prolong the inevitable depression and make the next one worse. To be sure, it’s a painful process. Businesses will fail and jobs will be lost, but it’s a necessary cleansing that must take place to repair the damage.

Read up on the 1920-1921 recession. Government stepped back and it was over in a year. Compare that to the Great Depression where government did everything in its power to interfere with the readjustment process, and it lasted for 17 years.

This discussion is closed.