Exit Interview is a new Signal vs. Noise series that talks to founders to see what happens after companies get acquired.

“We’re betting that Shopzilla will become the way that people shop online,” said Kenneth W. Lowe, president and CEO for EW Scripps in June of 2005, after the company bought Shopzilla for $562 million in cash. Shopzilla co-founder Farhad Mohit echoed, “With Scripps and its lifestyle brands, media assets and financial resources backing our team and vision for building the ultimate shopping service, we are assured of the chance to continue building Shopzilla into a site that consumers worldwide will choose every time they want to shop online.”

“We’re betting that Shopzilla will become the way that people shop online,” said Kenneth W. Lowe, president and CEO for EW Scripps in June of 2005, after the company bought Shopzilla for $562 million in cash. Shopzilla co-founder Farhad Mohit echoed, “With Scripps and its lifestyle brands, media assets and financial resources backing our team and vision for building the ultimate shopping service, we are assured of the chance to continue building Shopzilla into a site that consumers worldwide will choose every time they want to shop online.”

But it didn’t take long for the partnership to sour. Mohit now says, “It became obvious to me that Scripps was more interested in milking the search engine marketing arbitrage cash-cow that we had created, than in going after true customer loyalty by offering a universal shopping cart enabled service that could take on Amazon.”

Mohit was also disappointed that Scripps didn’t offer more incentives to the Shopzilla team. He says, “In order to execute on the big vision, I told corporate that they would have to put aside a good sized employee pool tied to Shopzilla’s performance (not Scripps performance overall which we could not really affect) and to give a healthy percentage of the upside to our employees, financially incentivising everyone to bust ass to take us from a $500 million company to a $5 billion one.

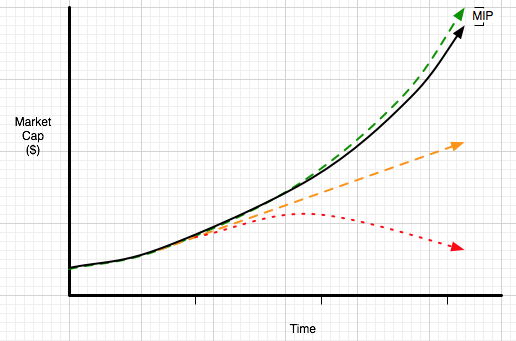

“I remember telling them that even if they give $1 billion to the employees, if they ended up with a $5 billion company it would be worth it. I illustrated this with a simple graph that showed three possible trajectories that corporate could bet on happening, depending upon how well they kept their best and brightest engaged.

"They declined to offer a significant ‘MIP’ — Management incentive Plan — and they ended up right in between the orange and red lines."

Parting ways

By Febuary of 2007, Mohit had seen enough and left. "When I saw that our vision was not going to be executed and that our corporate parent was more interested in managing costs, there was not much reason to stay any longer." Mohit, Henry Asseily (CTO and co-founder), and John Phelps (CEO at the time and employee #8) all quit at the same time.

"Innovation essentially came to a standstill after the sale and has continued to be frozen for years," according to Mohit. "In nominal terms, they are just as well off. But in relative terms, given all the innovation that has taken place in the commerce landscape, and the advent of social, mobile, local, and online-to-offline commerce, I feel that Shopzilla totally missed the opportunity to build a monster franchise."

At least the positive atmosphere the founders set up endured, according to Mohit. "We created a great company atmosphere and had a bunch of lovely people working at Shopzilla," he says. "It’s good to know that many of them still remain at Shopzilla and I keep hearing good things from anyone who works there. So, it seems like the work atmosphere we created back in the day has endured somewhat, despite the slowing down of innovation. For that, I give the current management credit.

"That said, I can honestly say that while I love and miss my colleagues, I don’t miss the corporate environment one teeny bit. Large, public corporations are rarely a place for innovation or for creative people who want to do something personally meaningful or societally impactful."

Avoiding implosion

Despite the eventual fate of the company, Mohit still feels a sale had to be done. "If we had not sold it, we would have imploded under the fighting of management, CEO, and VCs. At the time, there was quite a bit of disagreement about what Shopzilla should do and who should lead. Also, the VCs had been in for long enough and wanted their money out. The CEO was mainly concerned with protecting his brand and was not much use when push came to shove. And, the rest of us who were doing the real work didn’t feel properly appreciated. Overall, it wasn’t a very healthy situation and could have led to a collapse of what we had built to that point. So, the sale was needed because it allowed the shareholders to have a successful exit and for the company to continue on."

Mohit feels the site had a chance to succeed if it received the proper backing from Scripps. He says, "If we’d been given a corporate mandate to follow through on their investment vision and go for the big prize, I think that today we’d have built a one-stop meta shopping site where you could close a transaction, but be sure that fulfillment would be taken care of by whoever could give the best prices and service, whether that be Amazon or some rinky-dink site on the web. As a customer, you’d know that Shopzilla is the only name you need to remember shopping online, because you’d be shielded from the negatives and guaranteed by Shopzilla that you’re getting the best deal possible. We’d be giving Amazon a serious run for it’s money."

Mohit feels the site had a chance to succeed if it received the proper backing from Scripps. He says, "If we’d been given a corporate mandate to follow through on their investment vision and go for the big prize, I think that today we’d have built a one-stop meta shopping site where you could close a transaction, but be sure that fulfillment would be taken care of by whoever could give the best prices and service, whether that be Amazon or some rinky-dink site on the web. As a customer, you’d know that Shopzilla is the only name you need to remember shopping online, because you’d be shielded from the negatives and guaranteed by Shopzilla that you’re getting the best deal possible. We’d be giving Amazon a serious run for it’s money."

That’s not how it turned out, though. "As it stands today, Shopzilla still doesn’t have any real relationship with users," says Mohit. "No registration or credit card info. Nobody remembers to come to Shopzilla first. And we continue to need to buy traffic and have low customer loyalty."

A nice exit vs. a stuck site

Looking back, Mohit sees pros and cons to selling. He says, "The best thing about selling, of course, is that the shareholders, including myself, were able to have a very successful exit. The worst thing was watching something that could have been great get stuck at good."

He warns others against buying into the sell-and-prosper idea. "I think that the idea that you will be selling to get additional resources to follow your dream may not turn out to be real," he explains. "But the reality of liquidity for shareholders, especially after a long and tough slog, is very enticing. Every situation is different, but selling to a corporate parent is typically not a very romantic ending for your company."

His advice to other startups? "Be pragmatic and really look at what you’re getting that is guaranteed. The stuff you imagine could come as a result of additional resources in the future may never pan out, as your company is usually not in the driver’s seat and corporate priorities change frequently."

Now what?

Now Mohit is working on a start-up called Gri.pe, which is a mobile app focused on helping people get service complaints heard and resolved with the help of their friends. He says, "It’s fun to be back at a six person start-up, focused purely on making a great product that people will love."

"I learned a lot while at Shopzilla," he says. "So, hopefully we’re avoiding some of the same mistakes. And, we did some good things. So the track record means that we’re fortunate in the quality of people and investors that we get to work with, which is a true blessing."

Has the money he received changed his life? "In some ways it has," he answers. "I own a nice house, for instance. I am involved in several philanthropic activities. I am funding my latest start-up myself. In other ways, not so much. I drive the same style car I did in college, a VW GTI. I wear the same clothes and have many of the same friends. And my mother still worries if I’ve eaten enough and had enough sleep."

AC

on 01 Mar 11Just some candid feedback, this article, while a good idea, was not all that interesting unfortunately.

The nature of these posts (Exit Interview) will all probably be the same.

1. Personal sells company.

2. Person now no longer has control to make decisions of said company..

3. Person is either A) lucky the acquisition was success and loves the acquiror, or B) more likely a failure because the product/service becomes stale and the founder is unhappy and leaves (but with pockets full of money).

Nathan Bowers

on 01 Mar 11Innovation essentially came to a standstill…

Nathan Bowers

on 01 Mar 11(My comment got cut off, either by my iPhone or by your comment parser.)

Anyway, I think acquisition halts innovation because the sale finally puts a dollar value on the startup, so the attitude shifts from creating value to defending the investment. Playing not to lose instead of to win.

Dave S

on 01 Mar 11@Matt – I liked the article and unlike @AC think there is more than one storyline for this topic. I understand there are consequences for all business decisions, good and bad. Hearing about the issues will only give us more perspective when making these decisions ourselves.

I think it would be nice to hear from Zappos and Tony Hsieh, who probably had a slightly different outcome from Shopzilla.

AC

on 01 Mar 11@Dave S

It’s been public knowledge for a long time that Tony Hsiesh was forced sell Zappos to Amazon due to pressure from his investors who wanted to cash out:

Just a few articles for your reading:

- http://www.inc.com/magazine/20100601/why-i-sold-zappos.html

- http://blogs.reuters.com/felix-salmon/2010/06/07/how-sequoia-forced-tony-hsieh-to-sell-zappos/

Anonymous

on 01 Mar 11How can I contact Matt?

Richard

on 01 Mar 11While this new series is one that lots of people are probably interested in, when the historical accounts come from the primary person involved the most valuable (or juicy) bits will never be told. This person will not reveal anything embarrassing but highly relevant about the VCs, management team of the buying company, or pretty much anyone else. You really need a third party reporter to do the digging, find sources which will talk under the protection of anonymity, corroborate multiple interpretations of events and put it all together in one nice story. This is the reason books like Startup are damn boring and books like The Witch Doctors are damn interesting. This series promises to be the former.

ML

on 01 Mar 11Anonymous: You can reach me on Twitter @mattlinderman or email matt at 37signals…

Scott

on 01 Mar 11Regarding comments that it would be nice to hear from Zappos and Tony Hsieh and that Tony Hsiesh was forced sell Zappos:

It’s also worth noting that Tony Hsiesh was not a founder of Zappos but an investor. This series intends to “talks to founders” which in it’s literal sense would Hsiesh out of the running.

ML

on 01 Mar 11AC, Richard, and others: Thanks for all the feedback. Will def consider these views as we move forward with the series.

Scott

on 01 Mar 11Also worth noting that Zappos is not the traditional “founder starts with an idea, starts small, grows and is acquired”. It took millions of dollars of investment from Hseih to build out the infrastructure and technology that makes Zappos possible before they were acquired.

Will

on 01 Mar 11I find the aspirational message of the “Bootstrapped” series much more appealing and interesting than what can only be assumed will become the cautionary message of the “Exit Interview” series.

Future Billionaire

on 02 Mar 11Looking forward to this series.

Mike

on 02 Mar 11Despite others’ feelings, I am very interested in this series. So I guess count me as a vote for “let’s hear more!”.

If you want to hear about Hseih, read the book. Personally I would love to hear more about companies that weren’t headline news. Who cares about myspace? What about College Humor? I heard the original founder sold it for like $100k? Jobing.com has acquired a bunch of smaller bootstrapped job sites… Those would be cool to hear about. Or how about bnbonline.com, IB bought them, and they seem to be doing better now than before…

What about non-dotcoms? What about a company P&G bought? Maybe one in the 60’s or 70’s? That would be a sweet read.

Dmitry M

on 02 Mar 11I think, for this exit interview series to be even more interesting, you also need to find some people excruciatingly happy with their exits. This is what interests me: sure, Yahoo mediocratizes their acquisitions, or the founders don’t have anything left to do, and the founders are unhappy. I think this is one of the key viewpoints of 37signals. But are there happy sellouts? As someone building a business, I’d like to know. As for the acquisition of Shopzilla, regarding the billion-dollar incentive request: how does he know throwing incentives at developers would get Shopzilla to grow in value ten times over? Why would the acquiring company take such a risky prediction, and essentially triple their acquisition cost on the belief of the founder in his company?

bob marteal

on 02 Mar 11Interesting read. Seems to really support a book i read once called.. um.. oh yeah Rework. It is nice to hear hardwork and dedication drive creativity and innovation. It is also frustrating to see that stifled by big business.

Mark

on 03 Mar 11I agree with the commentor go suggested going out and finding some non-web related stories out there. And while I realize it’s against your overall message, it’d be refreshing to read some success stories too.

Dan

on 03 Mar 11How’s Mint going? They didn’t even developed an API yet.

Although intuit’s stock value doubled after aquisition.

This discussion is closed.