Kiva is amazing. It’s a site that lets you make microloans to working poor entrepreneurs in the developing world. Farmers, shopkeepers, builders, textile workers, and shoe sellers in Azerbaijan, Samoa, Togo, Kenya, Ecuador. Kiva helps you help them for as little as $25 at a time.

It’s a loan

This isn’t charity, it’s a loan. Amazingly, 99.7% of loans are repaid. When your Kiva loan is repaid, you can choose to withdraw your funds or re-loan to a new business. It’s a wonderful idea well executed.

One-to-one lending

What’s especially cool is that you are helping one person (and their family). It’s a laser-pointer approach to helping people. Pick one person to help, watch their progress, get paid back, loan them more if they need it.

It’s a refreshing alternative to donating to a mega-charity that blurs the connection between your help and a specific human being. Instead of tossing a dollar in a pile to be mass distributed at a later date, Kiva lets you “look someone in the eye,” hand them the dollar, tell them you’re behind them, and wish them good luck. That’s extra special for the giver and receiver.

The lending process is beautifully simple which is a big part of the appeal. Here’s how simple:

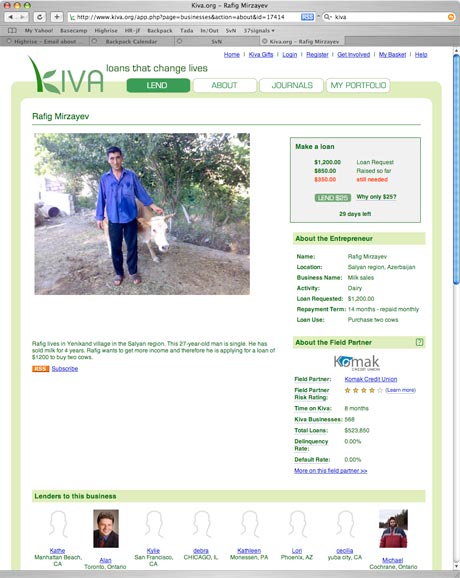

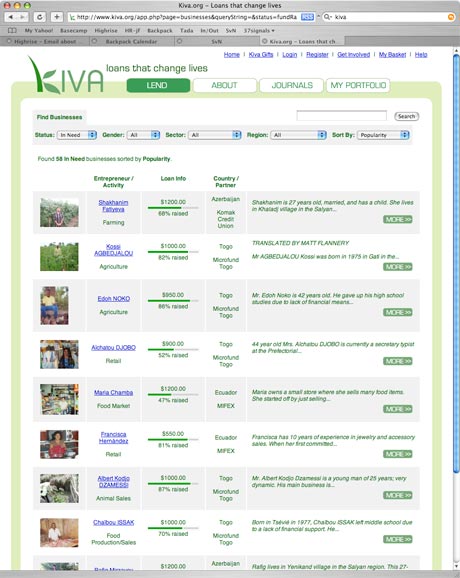

Browse business owners in need

Click someone for more detail

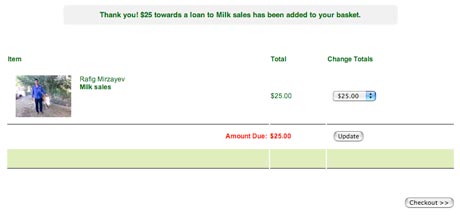

Choose to lend as little as $25

Pay with PayPal or a credit card. PayPal provides Kiva with free payment processing – Kiva.org’s largest variable cost – so 100% of the loaned funds reach entrepreneurs in developing countries.

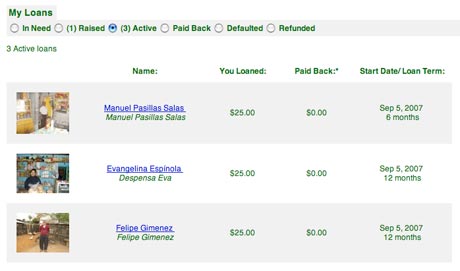

Keep an eye on your loans

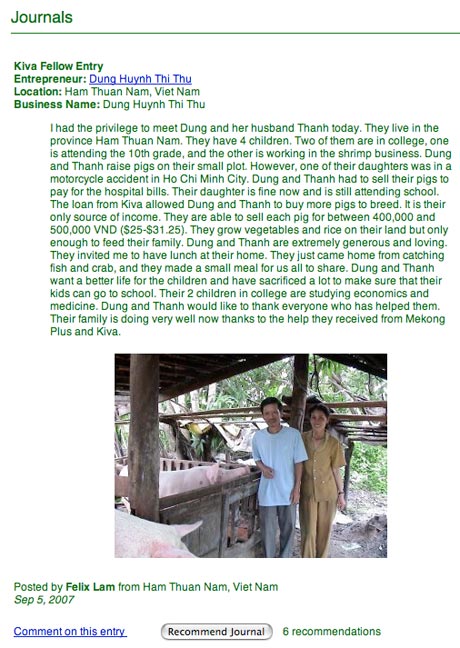

Follow along on their journals

That’s it

It’s simple, fast, easy, and direct. 100% of the donation goes right to the person in need. Kiva’s administration costs are covered by separate donations to Kiva, not by taking a cut of the loans. When you make a loan you are also prompted to make an optional donation to Kiva to help keep their lights on.

For more information on Kiva, see their about page. And here’s a NYT video feature on Kiva.

Rajiv

on 05 Sep 07I agree. Kiva is great execution on a great idea for a very valuable service. It’s a such a postive experience for both borrower and lender. It’s founders have a good story too. Frontline World also did piece on Kiva:

http://www.youtube.com/watch?v=MXk4GUGXNTQ

This is great example of the democratic power of the Internet, and some recent technologies, like mobile phones.

Ryan Bergeman

on 05 Sep 07Very, very cool. Fifty bucks to us means a heck of a lot less compared to these entrepreneurs. It may just make or break them. Helping someone succeed and then getting your money back? Sounds like win-win to me; thanks for sharing.

RJ

on 05 Sep 07I really like this as a form of responsible charity. It’s great that I can be part of helping someone start a business in developing parts of the world.

At the same time, I really wish there was the concept of “interest”. Real loans usually have something in it for the lender – something other than the sense of good will and joy at having helped another person. I know this is a little Ayn Rand of me, but I’d be MUCH more likely to “invest” in a third world nation by asking for something as little as 3% interest than I am to let them borrow money for a while. Just giving users the option to require interest would greatly increase Kiva’s adoption. I’m not saying I won’t do it otherwise, but without interest it feels like charity.

Jonathan Brun

on 05 Sep 07What I love about micro-finance is that it is based on the same logic as open-source technologies and collaborative work.

Some of the features are

Strict rules: repayment in one year with weekly payments o This is similar to strong rules set by central body of programmers who do open source software o Easy way to identify delinquencies Groups are made of 5 people, the first two must complete half their loan before two more in the group receive theirs. o This reduces the work of enforcing loans as they pretty much self-enforce themselves. This is much like wikipedia or linux where people in the community weed out the useless individuals without the intervention of the central body Anyone can participate – no collateral needed Primarily focused towards women – who are more honest and better at managing money (among other things) Scalable and applicable anywhere in the world – even the industrialized world People get bigger and bigger loans upon completion of their previous loansJoshua

on 05 Sep 07RJ: Interest is required, but it’s paid to the local microfinance organization that’s actually processing the loan and collecting the payments. By avoiding interest from us, Kiva doesn’t have to handle all the tax and regulitory issues they might otherwise need to deal with.

Note though, that if the interest thing is important to you, there are other organizations you can work with that probably match your outlook better.

WmD

on 05 Sep 07Don’t forget about the Venture Voice with Premal Shah, president of Kiva:

http://www.venturevoice.com/2006/11/vv_show_41_premal_shah_of_kiva.html

Jason Clark

on 05 Sep 07Global X has an interview with the founders of Kiva, Matt and Jessica Flannery over on Social Edge:

http://www.socialedge.org/blogs/global-x/archive/2007/09/04/matt-jessica-flannery-kiva.org

Matt Flannery blogs on Social Edge too: http://www.socialedge.org/blogs/kiva-chronicles/archive/2007/09/01/chicago

RJ

on 05 Sep 07That makes sense – I hadn’t considered the tax issues. I guess if the local organization is taking more than a few percent already, adding another 2-3 on top of that could make it tough on people.

Anonymous Coward

on 05 Sep 07@RJ: These people are paying interest on these loans already, just not to you. This is a charity—and all you have to “give” is an imagined profit, and this buys impoverished people a chance to sustainably improve their lives and communities.

It sounds like the people collecting the interest are the people doing the work in the field. That doesn’t sound so unfair. You get your money back (most likely), the people get help with their businesses, the organization gets paid for setting the whole thing up.

I suppose interest for lenders might increase adoption, but this is hardly a reason not to support this site. This is innovation at its finest, and is a pretty strong pro-internet argument in that “Is the Internet good for the world” thread on this blog awhile back.

I do agree that it might be interesting to see how an interest-added option (not a mandatory option) would increase usage.

ChrisFizik

on 05 Sep 07Wow—that’s crazy c00l. May not be groundbreaking (micro-finance, etc) .. but comes across as very fresh

RJ

on 05 Sep 07@anonymous – yeah, I agree. I tried to make it clear that I didn’t think it was a bad idea or that interest was a “must”, just that it’s much more of a charity than some of the discussions will admit. It’s a great form of charity and a great way to feel like you’re helping responsible people in developing areas rather than just throwing money at someone who might not use it well.

Getting your money back and getting to read about their growing business is great, but since your earnings don’t ever exceed your investment, it’s a charity. If nothing else, the de-valuation of money over time implies that you really are losing money in this deal, and while it’s not very much, that makes this a charity.

Dave Peele

on 05 Sep 07Yeah, I saw this site featured on Oprah yesterday while watching with my wife. Great idea and very simple execution!

mike

on 05 Sep 07I can’t help but wonder how effective an anti-poverty program this will be.

For example, a massive percentage of Ethiopia’s population (+70M) lives more than a four hour walk from a road. The sorts of individuals who most need access to credit live far from digital cameras or web 2.0 websites. The sorts of people this site is likely to help are most likely middle class (third world but urban, literate, and having a fixed address) and have some access to credit already.

Not that it obviates all the benefit of the website, I just think perhaps this might distract people from traditional micro-credit which is more effective at reaching those who are most in need of credit.

Randy J. Hunt

on 05 Sep 07I’ve been using Kiva for a couple of years and I have to say the most rewarding part is getting the occasional updates from the loan recipients. It is really incredible to know how the money is being used.

My favorite: a woman purchased a second refrigerator to help her grow her beverage business. I love the industriousness.

monsters

on 05 Sep 07To clear up any confusion, you don’t make any money from lending to Kiva.

I’ve loaned to 6 business now, and they are all paying back, you get fun little updates.

I wrote a little blurb about it, not much, but at the time… http://bigmojo.net/monsters/?p=27

Kenny Johnston

on 05 Sep 07This is really awesome, great job 37Signals bringing this to our attention!

Mark Wintle

on 05 Sep 07I was trying to do four $25 loans and I got this:

“Due to the overwhelming response to recent Kiva press coverage, we will soon run out of businesses on our website. We are limiting everyone to one $25 loan today so that as many people as possible can try Kiva. We thank you for your understanding and for making a single $25 loan today.”

Rajiv Patel

on 05 Sep 07For those interested in microloans, distinct from charitable purposes, to make some money or receive it yourself, take a look at Prosper:

http://prosper.com/

Bob

on 05 Sep 07Mike, the recipients aren’t the ones interacting with the website. The Kiva field reps are out, making connections, meeting people, taking photos, and posting info on the Kiva site.

Tim Showers

on 05 Sep 07Slate did a solid ‘field test’ of the major web microfinance websites a few months back: (Spoiler: Kiva comes out on top) http://slate.com/id/2161797/

Gerry Kirk

on 05 Sep 07I had an interesting chat recently with Sam, the Kiva CTO. The biggest challenge they continue to face since their first media exposure is finding enough businesses to keep up with demand. That’s why from time to time they limit loans to $25 to try and give more lenders a chance to sign up. I guess 37Signals’ post will add to that challenge. ;)

It takes a lot of time and effort to build relationships with partners and to plug them into an online system and world that moves at a much faster pace.

I’ve been a lender with Kiva from the start and applaud their efforts.

Vanessa

on 05 Sep 07Yes spread the Kiva loving!! This year, I’ve chosen Kiva as my main channel for giving back to the world because it has such a direct connection to borrowers with an entrepreneurial spirit to better themselves. Very fulfilling as a lender!

Mimo

on 05 Sep 07Microfinance is pervert. Interest is pervert. Natural laws do not behave like this. Because the one who gives the money (it doesn’t mind to whom and what the amount is) is going to gain. No risk. The one who get’s the money has to do all the work and to take all the risk. If you plant a tree you are not sure if it will grow. There are many risks. The same principal should be established in human moneysystems. No matter where on the world.

Jon

on 06 Sep 07I saw a TV spot on Kiva, and 100% of cooperative members meet their loan commitments for 2006! That’s awesome. It means the system is working.

The word Kiva is a Native American term for an in-ground room for religious rituals – they are amazing structures. Check them out at Mesa Verde National Park in Colorado.

Ryan Sievert

on 06 Sep 07This is a great idea, but I can’t help wishing that a similar system existed to help people struggling in my own country. I imagine that watching the progress of a small business that had been ravaged by Katrina would be much more rewarding than giving money to the Red Cross and wondering how much of my actual donation made it into the hands of the people who needed it.

Anonymous Coward

on 06 Sep 07This is a great idea, but I can’t help wishing that a similar system existed to help people struggling in my own country.

So get working and start one. The founders of Kiva did just that. It was just a husband and wife team. Unassuming people with an idea. They made it happen. Will you?

Beno

on 06 Sep 07Kiva.org is an awesome site and idea!! I love the fact that the money is not given to the entrepreneur as a hand out but something that they will have to pay back. This will ensure that the entrepreneur will have to actually work towards earning an income so that he/she can pay the loan back rather than just take “free” money and spend it unnecessarily.

May

on 06 Sep 07I agree about Kiva, I’ve been supporting it for nearly a year and love it. So far, my loan is being consistently and regularly repaid. It makes me happy and proud ever time I get a notice of a payment. I’m happy that in my small way, I’ve help someone to succeed. It’s also inspirational to me, so see people do so much with what little they have. A great cause and a real opportunity for the average person to reach out and make a connection. Thanks for spreading the word about a wonderful organization.

Bob

on 06 Sep 07Not having interest does not make this a charity. Interest is not a concept that extends to lending everywhere. Banks that follow Islamic Sharia principles never charge interest in any of their loans.

Megan

on 06 Sep 07So not too dissimilar from myfreeimplants.com eh? lol

Tory

on 06 Sep 07@Bob: if the lenders aren’t profiting from it, then it’s charity.

Kishore Balakrishnan

on 06 Sep 07interview of matthew and jessica flannery @ iinovate posted on sep 4, 2007

amosisreal

on 07 Sep 07They must have a great advertising agency – this was on 37s, NPR several times in different interivews, Clark Howard, etc all on the same day.

It’s a great idea and I look forward to becoming part of the community.

Steve Woods

on 07 Sep 07I don’t think its anything to do with having a great advertising agency amosisreal, i think it’s more to do with people recognising a good cause thats worth talking about.

I’ll be signing up immediately – i’m hardly rolling in cash, but being able to help someone who REALLY has it bad and who could lose everything is worth such a negligible outlay. Then getting the money back at the end anyway?

Fantastic.

amosisreal

on 07 Sep 07@-Steve Woods

I dont disagree that its a good cause – i think its an amazing idea – the aggregate of the internet is a wonderful and under-utilized phenomena (for good).

Its just quirky that so many disparate (but probably related) sources picked up on it in such a short interval – given the length of time the organization has been around.

thats all.

JF

on 07 Sep 07They must have a great advertising agency

They could, but I wouldn’t know. They didn’t contact us. I heard about the site from a friend, checked it out, and posted about it.

:(

on 07 Sep 072 days since the last SVN post

Sad face

Anonymous Coward

on 10 Sep 07They have an interview on venturevoice.com from a long time ago. Its interesting, check it out.

BC

on 10 Sep 07Amazingly, they have funded every business on the site!

http://www.kiva.org/app.php?page=businesses

evbart

on 10 Sep 07Great site. Great execution. One of my favorite places on the web. Clear UI with useful feedback/reports about your activities. It keeps the users engaged.

They also seem to do a good job of keeping it transparent.

Just to answer someone’s question. They don’t target the entrepreneurs directly, who most often wouldnt have computer access. The local micro-finance institutions are the ones posting the profiles and using the web on behalf of the entrepreneur.

Agent Red

on 11 Sep 07Kiva is Kool. We can’t wait to make our first loan. As a former struggling entrepreneur, its a natural to be a part of this wonderful movement.

Carol ter Stege

on 11 Sep 07Hello Kiva,

It’s nice to see that we are not alone in helping people to start as an entrepreneur to help themselves and the family. by setting up microprojects. Please visit our sites of www.learningcompanies.nl and www.microprojects and see what keeps the students busy at the Hogeschool Drenthe.

Secretariat International Learning Companies Hogeschool Drenthe Mrs. Carol ter Stege

Waqqas

on 12 Sep 07Could anyone tell me, what countries is Kiva operating in? Is Pakistan on the list? If they are looking for more needy recepients, I can put them in touch with people from my village back in Pakistan.

Iolaire McFadden

on 12 Sep 07I missed the post because I was on vacation, but I’m very happy you mentioned it. I’ve donated money to Kiva for 1-2 years now and have been very happy. Just this week two of my Gaza loans were defaulted on, but that is understandable due to the fighting over the course of this year. I was very happy to see that there were 0 opportunities to re-loan the money that was paid prior to the default. Check back in a few months once the current hype dies down and you can find opportunities to loan…

Waqqas – Kiva works with local agencies who distribute the loans see: http://www.kiva.org/about/partners/. If you wanted to get something set up you would need to help them find a valid agency who distributes money and collects it.

This discussion is closed.