Never tell anyone you’ve “been busy.” Everyone is busy.

About Jason Fried

Jason co-founded Basecamp back in 1999. He also co-authored REWORK, the New York Times bestselling book on running a "right-sized" business. Co-founded, co-authored... Can he do anything on his own?

PRESS RELEASE: 37SIGNALS VALUATION TOPS $100 BILLION AFTER BOLD VC INVESTMENT

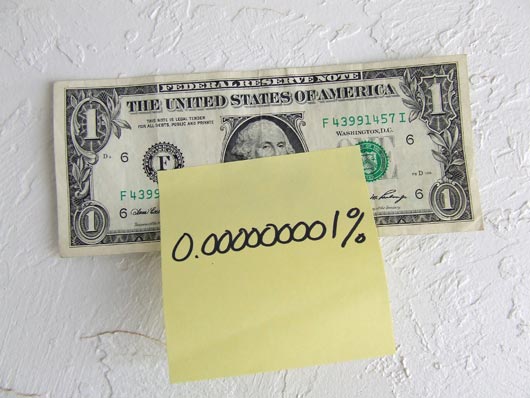

CHICAGO—September 24, 2009—37signals is now a $100 billion dollar company, according to a group of investors who have agreed to purchase 0.000000001% of the company in exchange for $1.

Founder Jason Fried informed his employees about the new deal at a recent company-wide meeting. The financing round was led by Yardstick Capital and Institutionalized Venture Partners.

In order to increase the value of the company, 37signals has decided to stop generating revenues. “When it comes to valuation, making money is a real obstacle. Our profitability has been a real drag on our valuation,” said Mr. Fried. “Once you have profits, it’s impossible to just make stuff up. That’s why we’re switching to a ‘freeconomics’ model. We’ll give away everything for free and let the market speculate about how much money we could make if we wanted to make money. That way, the sky’s the limit!”

Proof that 37signals is now a $100 billion dollar company.

Proof that 37signals is now a $100 billion dollar company.

A $100 billion value for 37signals is “not outlandish,” says Aanandamayee Bhatnagar, a finance professor and valuation guru at Grenada State’s Schnook School of Business. Bhatnagar points to a leaked, confidential corporate strategy plan that projects 37signals will attract twelve billion users by the end of 2013.

How will the company overcome the fact that there are only 6.8 billion people alive today? “Why limit users to people?” said Bhatnagar.

In order to determine the valuation of companies, Bhatnagar typically applies the following formula: [(Twitter followers x Facebook fans) + (# of employees x 1000)] x (RSS subscribers + daily page views) + (monthly burn rate x Google’s stock price)2 and then doubles if it they use Ruby on Rails or if the CEO has run a business into the ground before. Bhatnagar admits the math is mostly a guess but points out that “the press eats it up.”

To help handle the burdens of an increased valuation, 37signals hired former YouTube exec Craig Mirage as Chief Operating Officer earlier this month. Mirage hopes to replicate YouTube’s valuation success at 37signals. “Of course, the investment comes with great expectations. But you should see the spreadsheet models we’re making up. Really breakthrough stuff,” said Mirage.

“37signals will lead the new global movement filled with imaginary assumptions on growth and monetization potential,” he continued. “We’re excited to roll out a list of unconfirmed revenue possibilities that involve crowdsourcing, a robust set of widget creation tools, 3G, augmented reality, social stuff, and an app store. Also, everything we make will include a compass.”

The best way to graduate from beginner is to get in way over your head. Nothing makes you better faster.

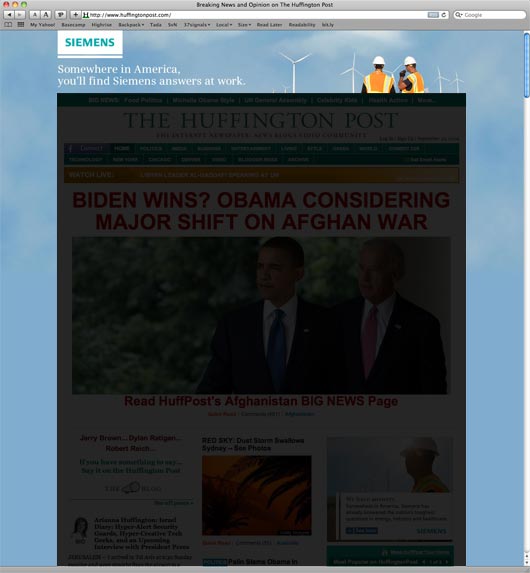

Landmine advertising at The Huffington Post

Just noticed that Siemens bought the entire background at The Huffington Post. A click anywhere in the blue (outside the bounds of the content section I’ve faded to black below) will take you to a Siemens landing page.

So they aren’t just buying the background display, they are buying any clicks outside the content area. I wonder how many accidental clicks they’re getting and how much THP is charging for a full background buy. And I wonder who pitched the idea — the publisher or the advertiser. Have you ever seen this on another site before?

If you’re describing something, and you find yourself saying “blah blah blah” to close out the thought, it may not just be a shortcut to the next sentence. Instead, it may be a sign that you haven’t thought enough about what you’re trying to describe. Try finishing your explanations with real words to make sure you’re actually on the right track.

Signs on signs

I love taking pictures of signs on signs. They usually point to bad design (literally). Here are some of the ones I’ve taken lately.

Warren Buffet on scheduling meetings

I recently heard about Warren Buffet’s approach to scheduling meetings. I can’t confirm this is true (I’ve never met him), but I hear from a reputable source that he usually doesn’t set up meetings more than a day in advance.

If someone wants to see him, they are told to call and set up the meeting when they can see him tomorrow. So if you want to meet with him next Friday, you call on Thursday and say “Can I see Mr. Buffet tomorrow?”

I love the simplicity of the rule: I can see you today if you asked me yesterday, but I can’t fill up my schedule any further in advance. This way he can determine how he wants to spend his time within the context of the next 24 hours instead of booking things weeks or months in the future. Now his schedule is relevant instead of prescient.

The next generation bends over

Mint’s sale to Intuit really pissed me off.

Why should I care? Because I think it’s indicative of a VC-induced cancer that’s infecting our industry and killing off the next generation. I don’t know the full backstory, but I’d bet this sale was encouraged by a Mint investor.

Here’s a fresh new company that was gunning for an aging incumbent. And not only gunning, but gaining. They had a great product, great design, and great potential. They were growing rapidly and figured out the revenue game. They were on their way to redefining an industry — one that was left for dead by the current custodians.

They were everything their main competitor, Intuit, was not. While Mint was inventing, Intuit was out of it. People used Quickbooks/Quicken out of habit and legacy. People used Mint because they loved it. Intuit was disgruntled, Mint was disruptive.

Continued…Michael Jordan's induction speech

Heartfelt, honest, competitive, and hopeful. A great speech by MJ.

Continued…

A new site/product/thing we’re working on. Just a little out of focus. Any guesses?