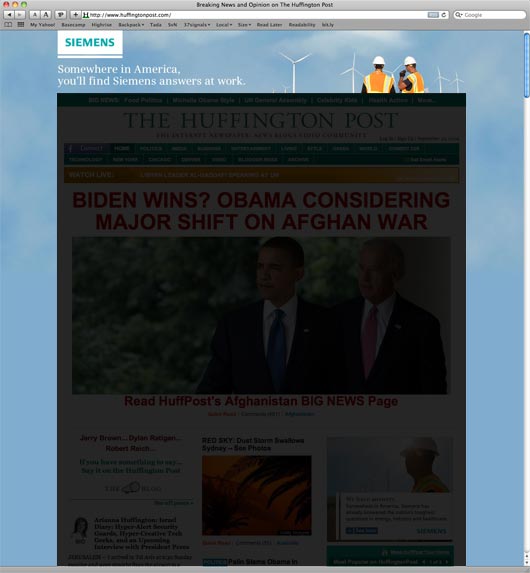

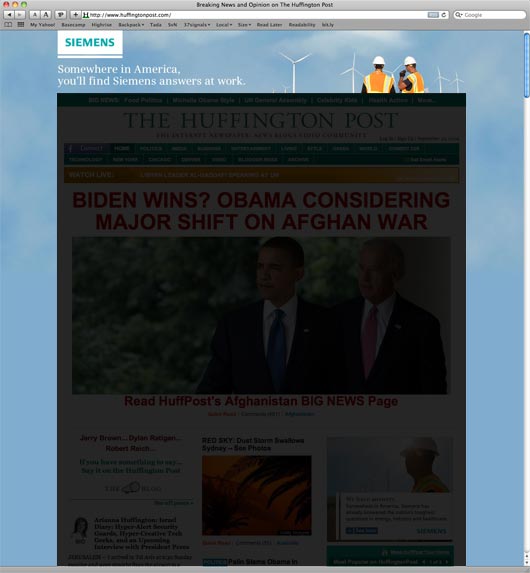

Just noticed that Siemens bought the entire background at The Huffington Post. A click anywhere in the blue (outside the bounds of the content section I’ve faded to black below) will take you to a Siemens landing page.

So they aren’t just buying the background display, they are buying any clicks outside the content area. I wonder how many accidental clicks they’re getting and how much THP is charging for a full background buy. And I wonder who pitched the idea — the publisher or the advertiser. Have you ever seen this on another site before?

I was watching a Q&A presentation at a conference a while back. Several questioners said something along these lines: “I was so inspired by what you say that I decided to quit my job and start a new business!” And then the whole room broke out in applause.

Seen this sorta thing elsewhere too. Someone says, “I quit my job to follow my dream of [starting XYZ business/acting/whatever].” And everyone oohs and ahhs and says how great it is.

My problem with that: Quitting your job is easy. That, on its own, doesn’t deserve applause. If you quit and start something new and persevere for years and make it happen, then you deserve hosannas. But just quitting? Anyone can do that.

And starting something is only a little bit harder. It’s easy to start something. Following through is the tough part. Just look at the landscape of abandoned blogs that litter the web for proof of that.

Contrast that to the reaction people who keep their day jobs and build something on the side get. Actually, they don’t get much reaction at all. There are no dramatic, sweeping statements about quitting so people don’t care as much.

Too bad. Doing what you love on the side means you don’t have to risk everything immediately. You have a steady income so you’re less desperate. You can build it slowly until whatever it is is such a success that it justifies quitting your regular job. It’s a measured approach instead of a toss of the dice. Plus, you can easily turn around if you go down the wrong path (or lose motivation).

Maybe these “keep the day job and build it on the side” folks are the ones who really deserve the applause.

I love taking pictures of signs on signs. They usually point to bad design (literally). Here are some of the ones I’ve taken lately.

Continued…

Early retirement is a mirage when you’re physically and mentally capable of doing more. Humans are generally not built to derive sustainable happiness from sipping mojitos on a picturesque island somewhere in the pacific. Once you’ve tasted the sweetness of a dedicated purpose, it’s near impossible to be content just sitting on the sidelines.

I’ve talked to a handful of start-uppers who build the company of their passion and then cashed in for this dream. But the pattern was pretty much universally the same: Six months of doing nothing but indulging pleasure is as long as most highly capable individuals can take.

So after a much-needed vacation, the retirement is canceled and they’re back to start a new company. (Not always with as much passion as the first time around, but that’s another story).

Continued…

I recently heard about Warren Buffet’s approach to scheduling meetings. I can’t confirm this is true (I’ve never met him), but I hear from a reputable source that he usually doesn’t set up meetings more than a day in advance.

If someone wants to see him, they are told to call and set up the meeting when they can see him tomorrow. So if you want to meet with him next Friday, you call on Thursday and say “Can I see Mr. Buffet tomorrow?”

I love the simplicity of the rule: I can see you today if you asked me yesterday, but I can’t fill up my schedule any further in advance. This way he can determine how he wants to spend his time within the context of the next 24 hours instead of booking things weeks or months in the future. Now his schedule is relevant instead of prescient.

Mint’s sale to Intuit really pissed me off.

Why should I care? Because I think it’s indicative of a VC-induced cancer that’s infecting our industry and killing off the next generation. I don’t know the full backstory, but I’d bet this sale was encouraged by a Mint investor.

Here’s a fresh new company that was gunning for an aging incumbent. And not only gunning, but gaining. They had a great product, great design, and great potential. They were growing rapidly and figured out the revenue game. They were on their way to redefining an industry — one that was left for dead by the current custodians.

They were everything their main competitor, Intuit, was not. While Mint was inventing, Intuit was out of it. People used Quickbooks/Quicken out of habit and legacy. People used Mint because they loved it. Intuit was disgruntled, Mint was disruptive.

Continued…