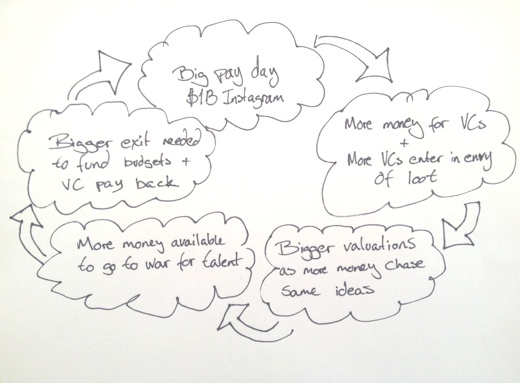

Remember way back to, oh, six months ago when champagne was popping and markets were roaring? Back when companies with no or few profits could premiere on the world stage to grand applause by merely converting a dollar into fifty cents? Those were the good times of boom, boom, pow.

It’s amazing how quickly everyone has gone from rocking out to that tune to loathing those same beats. But that’s exactly what’s happened to the pop stocks of just a few minutes ago. Here’s a brief recap of just the last six months for three former stars:

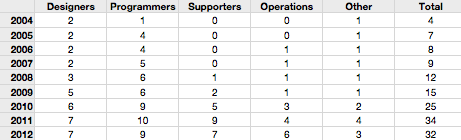

- Zynga peaked at $15 in March, it’s now trading at $3. $8 billion has disappeared from its market cap.

- Groupon hit $25 in February, now it’s at $8. That’s another $10 billion in market cap lost.

- Facebook started at $38 in May, now down to $24. With almost two billion shares outstanding, that’s meant a drop of $27 billion — give or take — and a current market cap of $44B (not too far off the $33 billion I wouldn’t have paid two years ago.)

So between just these three, some $40 billion has been extracted from the market caps that pension funds and other last-sucker-in-line investors bought into. While, in the process, soured many on the idea of the public markets and enriched investment bankers hawking the toxic stocks. Hey, at least someone got out while the going was good.

Can someone kick the radio? We need a remix to get this party started again. Or we could, you know, change the channel and start valuing stocks based on fundamentals.

Nah, on second thought, fuck that. I hear Twitter is going for a $10B IPO. This Time It’s Different!

Note: Clarified the $40B extraction.