Exit Interview is a Signal vs. Noise series that talks to founders to see what happens after companies get acquired.

Webshots

Webshots has been acquired multiple times. Webshots Founder Nick Wilder:

Webshots has quite a sordid history: we sold it to Excite@Home in 1999, they went bankrupt, we bought it back (97% off) in 2002, and sold it again to CNET in 2004. American Greetings bought it from CNET about two years ago.

After buying it back from Excite, we immediately figured out how to make it profitable and worked our asses off for a couple years. We had great growth, product development, and a huge profit margin, which made us an attractive acquisition.

CNET, despite being a company with great assets, was a disaster. They broke apart our team (engineering moved somewhere, ad sales went elsewhere, etc). They tried to move us to different server platforms. We accomplished absolutely nothing in the year I worked there. I quit on my 365th day, which was my part of the deal. The product seriously suffered, and users started dropping us for the newer photo sharing sites that were simply better.

CNET, despite being a company with great assets, was a disaster. They broke apart our team (engineering moved somewhere, ad sales went elsewhere, etc). They tried to move us to different server platforms. We accomplished absolutely nothing in the year I worked there. I quit on my 365th day, which was my part of the deal. The product seriously suffered, and users started dropping us for the newer photo sharing sites that were simply better.

Webshots has been in steep decline ever since, and it’s depressing to see your baby wither away. According to Alexa, it was once a top-20 ranked property (1999-2003 was the high); Now it’s around 1000.

It’s depressing to see your baby wither away.

TripUp

TripUp was acquired by SideStep in July 2007. TripUp Founder Samuel Rogoway:

SideStep’s acquisition of TripUp was bittersweet. On the one hand, we realized a successful exit in a market that was becoming increasingly saturated with travel social networks. Sidestep also had exciting plans for integrating and expanding our community features, which our users would have loved. On the other hand, Kayak subsequently acquired Sidestep and phased out TripUp, which was sad.

SideStep’s acquisition of TripUp was bittersweet. On the one hand, we realized a successful exit in a market that was becoming increasingly saturated with travel social networks. Sidestep also had exciting plans for integrating and expanding our community features, which our users would have loved. On the other hand, Kayak subsequently acquired Sidestep and phased out TripUp, which was sad.

I think Kayak missed a big opportunity to integrate interactive community features into their metasearch platform. Interacting with like-minded travelers and locals to plan and experience your trip offers value that traditional user generated content and editorial content cannot provide.

I think Kayak missed a big opportunity.

GrandCentral

GrandCentral (now Google Voice) was acquired by Google in July 2007 (rumored price: $50 million). GrandCentral Founder (and currently Entrepreneur in Residence at Google Ventures) Craig Walker:

When you get acquired, you have a sense that there is some grand plan of exactly what you are expected to do at the new company and that everybody knows what this is. In reality, it was a lot more chaotic than that. There was nobody telling us what we had to do. We were empowered to figure out the best course for GrandCentral (aka Google Voice) within the company and we got a lot of support at every turn.

When you get acquired, you have a sense that there is some grand plan of exactly what you are expected to do at the new company and that everybody knows what this is. In reality, it was a lot more chaotic than that. There was nobody telling us what we had to do. We were empowered to figure out the best course for GrandCentral (aka Google Voice) within the company and we got a lot of support at every turn.

It’s difficult to say what would have happened had we not sold. We definitely would have raised a pretty substantial Series B and would have continued to innovate at a rapid pace. We likely would have been able to roll out more features more quickly (one of the side effects of being part of Google is that everything you do must be able to support millions and millions of users immediately, which does slow down the pace of innovation at a start up), but would have lost out on the ability to quickly reach tens of millions of users. At the end of the day, more users were definitely better off due to the acquisition as it got out to many more people.

At the end of the day, more users were definitely better off due to the acquisition.

The only thing I wish that Google would have done differently would have been to tie the product more closely to Gmail early on. We launched this feature last summer (2010) and its been a great hit. Had we done that in 2008, it would have been better.

Continued…

SideStep’s acquisition of TripUp was bittersweet. On the one hand, we realized a successful exit in a market that was becoming increasingly saturated with travel social networks. Sidestep also had exciting plans for integrating and expanding our community features, which our users would have loved. On the other hand, Kayak subsequently acquired Sidestep and phased out TripUp, which was sad.

SideStep’s acquisition of TripUp was bittersweet. On the one hand, we realized a successful exit in a market that was becoming increasingly saturated with travel social networks. Sidestep also had exciting plans for integrating and expanding our community features, which our users would have loved. On the other hand, Kayak subsequently acquired Sidestep and phased out TripUp, which was sad. When you get acquired, you have a sense that there is some grand plan of exactly what you are expected to do at the new company and that everybody knows what this is. In reality, it was a lot more chaotic than that. There was nobody telling us what we had to do. We were empowered to figure out the best course for GrandCentral (aka Google Voice) within the company and we got a lot of support at every turn.

When you get acquired, you have a sense that there is some grand plan of exactly what you are expected to do at the new company and that everybody knows what this is. In reality, it was a lot more chaotic than that. There was nobody telling us what we had to do. We were empowered to figure out the best course for GrandCentral (aka Google Voice) within the company and we got a lot of support at every turn.

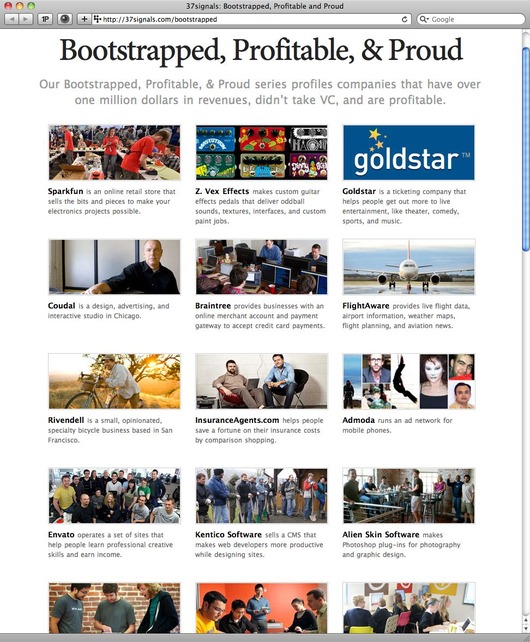

“You may not have heard of us, but chances are you run into people on a daily basis that have,” says

“You may not have heard of us, but chances are you run into people on a daily basis that have,” says